Do stocks of firms that initiate buybacks (open market stock repurchases) tend to appreciate due to elevated takeover risk? In the October 2013 draft of their paper entitled “The Timing and Source of Long-run Returns Following Repurchases”, Leonce Bargeron, Alice Bonaime and Shawn Thomas investigate the timing and source of the abnormal return associated with stock repurchases. They define abnormal return as three-factor (market, size, book-to-market) alpha from equally weighted portfolios of stocks associated with repurchasing activity. They focus on subsequent repurchase and takeover announcements as potential sources of long-run outperformance after repurchases. Using firm characteristics and monthly returns for stocks involved in 18,293 open market repurchase authorization announcements, with focus on 3,089 that have associated repurchase completion announcements, during January 1980 through September 2010, they find that:

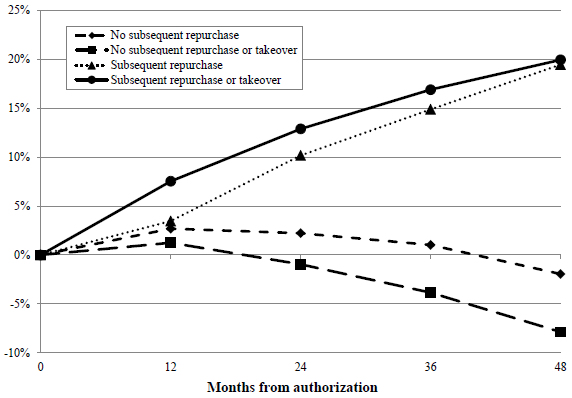

- For both the subsample of authorizations with completions and the overall sample, positive average gross alpha after repurchase announcements derives entirely from subsequent repurchase authorizations and takeover attempts (see the chart below).

- For example, from the overall sample (the subsample of matching authorizations and completions):

- When there are no subsequent authorizations, average gross monthly alpha is 0.22% (0.27%) over the 12 months after authorization.

- When there are subsequent authorizations, average gross monthly alpha is 0.29% (0.55%) over the 12 months after initial authorization.

- When there are either subsequent authorizations or takeover attempts, average gross monthly alpha is 0.63% (0.61%) over the 12 months after initial authorization.

- More specifically, average long-run outperformance after repurchase authorizations derives from aggregation of price jumps around subsequent repurchase announcements and takeover announcements.

- Controlling for a takeover risk factor eliminates outperformance of stocks involved in repurchase activity. In other words, the contribution of subsequent takeovers dominates the contribution of repeat repurchases in driving returns for past repurchasers.

- Findings are robust across subsamples and variations in methodology.

The following chart, taken from the paper, compares cumulative three-factor alphas for four subsamples of the overall set of 18,293 repurchase authorization announcements:

- Stocks with no subsequent repurchase authorization announcements

- Stocks with no subsequent repurchase authorization or takeover attempt announcements

- Stocks with subsequent repurchase authorization announcements

- Stocks with subsequent repurchase authorization or takeover attempt announcements

Results indicate that subsequent repurchase or takeover announcements are essential to stock outperformance, and suggest that the effect of takeover announcements dominates.

In summary, evidence indicates that stock repurchase announcements are noisy indicators of subsequent repurchases/takeovers and that price jumps during these subsequent events drive the future average gross outperformance associated with the initial repurchase announcements.

Cautions regarding findings include:

- Alpha calculations are gross, not net. Including costs of buying and selling based on repurchase signals would lower these alphas.

- As noted by the authors, the study is substantially retrospective and does not enable any exploitable refinement of a stock buyback investment strategy.