A subscriber suggested testing the diversification power of SPDR Barclays International Treasury Bonds (BWX) as a distinct asset class. To check, we add BWX to the following mix of asset class proxies (the same used in “Simple Asset Class ETF Momentum Strategy”):

PowerShares DB Commodity Index Tracking (DBC)

iShares MSCI Emerging Markets Index (EEM)

iShares MSCI EAFE Index (EFA)

SPDR Gold Shares (GLD)

iShares Russell 1000 Index (IWB)

iShares Russell 2000 Index (IWM)

SPDR Dow Jones REIT (RWR)

iShares Barclays 20+ Year Treasury Bond (TLT)

3-month Treasury bills (Cash)

First, per the findings of “Asset Class Diversification Effectiveness Factors”, we measure the average monthly return for BWX and the average pairwise correlation of BWX monthly returns with the monthly returns of the above assets. Then, we compare cumulative returns and basic monthly return statistics for equally weighted (EW), monthly rebalanced portfolios with and without BWX. We ignore rebalancing frictions, which would be about the same for the alternative portfolios. Using adjusted monthly returns for BWX and the above nine asset class proxies from November 2007 (first return available for BWX) through April 2013 (66 monthly returns), we find that:

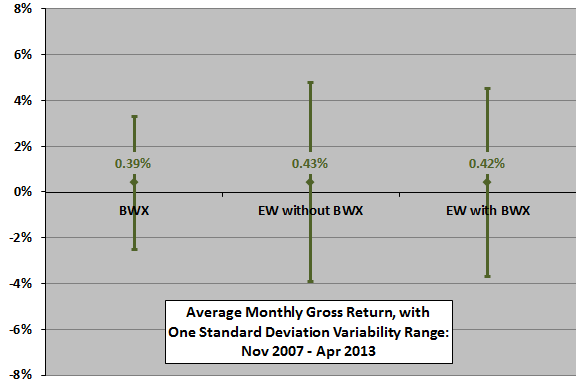

The following chart summarizes average monthly returns with variability ranges of one standard deviation for BWX and the EW portfolios without and with BWX over the available sample period. During this time, BWX generates a moderate positive average return with low volatility. Adding BWX to the diversified EW portfolio has little effect on return and slightly reduces volatility. The ratio of average return to standard deviation (return per unit of risk) is 0.10 (0.10) without (with) a BWX position.

The average pairwise correlation of BWX monthly returns with those of the other assets is a moderate 0.40 over the available sample period. Highest correlation is with EFA (0.66); that with TLT is only 0.22.

Per “Asset Class Diversification Effectiveness Factors,” the moderate positive average return (moderate average pairwise correlation) of BWX indicates a middling (middling) contribution with respect to portfolio diversification.

Sample size is not large in terms of number of months or variety of market conditions.

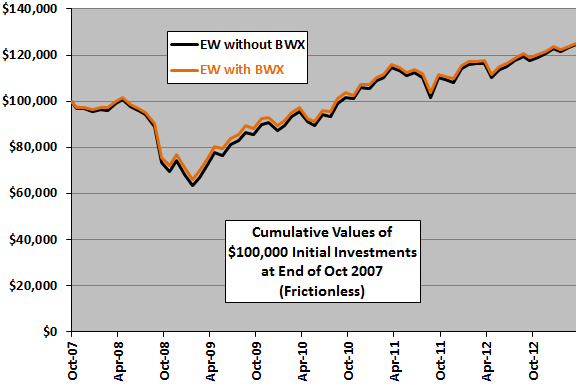

What is the net effect on cumulative portfolio performance?

The next chart compares cumulative values of EW portfolios without and with BWX in the mix over the available sample period. Adding BWX slightly improves cumulative return over the sample period, with improvement concentrated in 2009.

Again, sample size is not large.

In summary, evidence from simple tests over the available sample period supports belief that adding a proxy for international government bonds to a diversified portfolio modestly enhances overall performance.

Cautions regarding findings include:

- As noted, the sample period is not long in terms of market conditions.

- Including the trading frictions associated with monthly rebalancing would depress performance of both portfolios, depending mostly on portfolio size. When a portfolio of X assets performs just as well as one with X+1 assets on a gross basis, the former may be superior on a net basis.