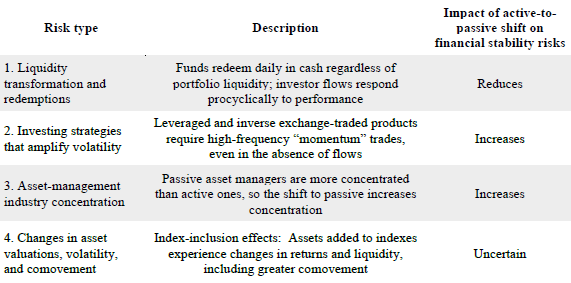

How does a shift in emphasis from active to passive investing affect the financial market risk landscape? In their September 2019 paper entitled “The Shift From Active to Passive Investing: Potential Risks to Financial Stability?”, Kenechukwu Anadu, Mathias Kruttli, Patrick McCabe, Emilio Osambela and Chaehee Shin analyze how a shift from active to passive investing affects:

- Investment fund redemption liquidity risks.

- Market volatility.

- Asset management industry concentration.

- Co-movement of asset returns and liquidity.

They also assess how effects are likely to evolve if the active-to-passive shift continues. Based on their framework/analysis, they conclude that:

- Growth of passive investing reduces liquidity risks associated with cascading redemption of shares, particularly because: (1) exchange-traded funds (ETF) mostly redeem shares of large holders in kind rather than in cash; (2) investors in passive mutual funds react less to performance than investors in active funds; and, (3) passive mutual funds typically hold more liquid assets than do active funds.

- However, growth of passive investing in leveraged and inverse ETFs exacerbates market volatility, because these funds must buy (sell) on down (up) days.

- Growth in passive investing concentrates the asset management industry, potentially magnifying consequences of asset management firm failure because: (1) passive funds tend to be more concentrated than active funds; and (2) investors seeking the lowest fees gravitate toward the economies of scale of very large funds (such as Vanguard and BlackRock).

- Growth in passive investing amplifies effects of: (1) valuation and volatility increases (decreases) for assets added to (removed from) indexes; and, (2) loss of index diversification due to increased comovement of returns and liquidity across index constituents.

The following table, taken from the paper, summarizes findings outlined above.

In summary, growth in passive investing decreases some kinds of risk and increases others, perhaps introducing opportunities for innovation in active investing.

Cautions regarding findings include:

- The paper is a synthesis of other research only.

- Histories of many passive investment vehicles are short for inference about long-term risks.