Several recent papers find that most studies identifying factors that predict stock returns are not replicable or derive from snooping of many factors. Is there a good counter-argument? In their January 2021 paper entitled “Is There a Replication Crisis in Finance?”, Theis Ingerslev Jensen, Bryan Kelly and Lasse Pedersen apply a Bayesian model of factor replication to a set of 153 factors applied to stocks across 93 countries. For each factor in each country, they each month:

- Sort stocks into thirds (top/middle/bottom) with breakpoints based on non-micro stocks in that country.

- For each third, compute a “capped value weight” gross return (winsorizing market equity at the NYSE 80th percentile to ensure that tiny stocks have tiny weights no mega-stock dominates).

- Calculate the gross return for a hedge portfolio that is long (short) the third with the highest (lowest) expected return.

- Calculate the corresponding 1-factor gross alpha via simple regression versus the country portfolio.

They further propose a taxonomy that systematically assigns each of the 153 factors to one of 13 themes based on high within-theme return correlations and conceptual similarities. Using firm and stock data required to calculate the specified factors starting 1926 for U.S. stocks and 1986 for most developed countries (in U.S. dollars), and 1-month U.S. Treasury bill yields to compute excess returns, all through 2019, they find that:

- Based on the specified approach, a large majority of the 153 factors replicate, survive joint testing of all factors, hold up out-of-sample and are strengthened by global evidence (see the chart below).

- A non-trivial (but not disastrous) minority of factors fail to replicate.

- Weakening of factor alphas post-publication is an expected outcome of Bayesian learning, not proof of data snooping. Results confirm the Bayesian prediction that higher pre-publication alphas should translate to higher post-publication alphas.

- 10 of the 13 factor themes replicate, the exceptions relating to size, seasonality and leverage factors.

- World factor gross alphas are economically meaningful, often over 0.3% per month.

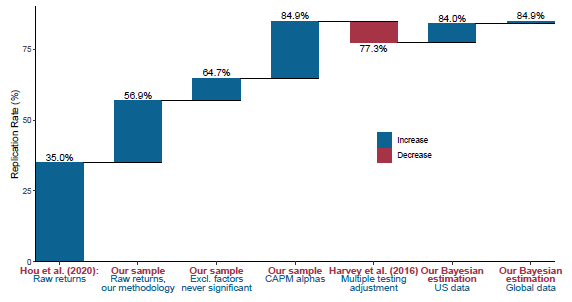

The following chart, taken from the paper, summarizes progression of equity factor replicability rate starting from a baseline of 35% replication rate for 452 previously published factors as presented in a recent influential paper to:

- 56.9% after: extending sample periods (+4.3%); focusing strictly on a 1-month portfolio holding interval (+4.0%); using capped value weights in factor portfolios as specified above (+8.5%); adding 15 factors to the baseline set (+2.4%); and, making minor changes to factor definitions (+2.7%).

- 64.7% after then excluding a number of factors found to be insignificant in original studies.

- 84.9% after then using 1-factor-gross alphas rather than gross raw returns to assess statistical significance.

- 77.3% after then applying a leading conventional method to account for multiple testing, thereby raising the threshold for statistical significance.

- 84.0% after then substituting for the conventional multiple testing correction a Bayesian model that directly tests joint behavior of all factors.

- 84.9% after then expanding the dataset to encompass 93 countries.

In summary, evidence indicates that most of the body of equity factor research is valid.

Cautions regarding findings include:

- It is not obvious that de-emphasizing roles of the largest stocks in factor return calculations is representative of investor experiences in the market.

- Findings are gross, not net.

- Accounting for data costs, monthly factor portfolio reformation frictions and shorting costs would reduce all returns. Shorting may not always be feasible as specified. Costs are likely material compared to gross alphas found in the study.

- Both the exclusion of factors with holding periods longer than one month and the factor portfolio weighting scheme makes reformation frictions in this study higher on average than those in the baseline study.

- Applying findings are beyond the reach of most investors, who would bear fees for delegating to a fund manager.