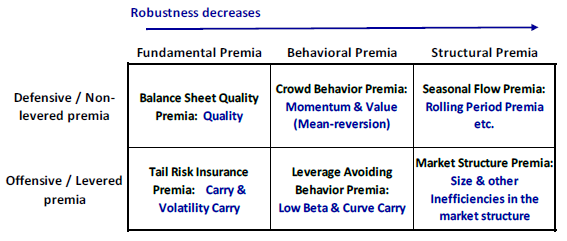

What is the best way to think about reliabilities and risks of various anomaly premiums commonly that investors believe to be available for exploitation? In their December 2017 paper entitled “A Framework for Risk Premia Investing”, Kari Vatanen and Antti Suhonen present a framework for categorizing widely accepted anomaly premiums to facilitate construction of balanced investment strategies. They first categorize each premium as fundamental, behavioral or structural based on its robustness as indicated by clarity, economic rationale and capacity. They then designate each premium in each category as either defensive or offensive depending on whether it is feasible as long-only or requires short-selling and leverage, and on its return skewness and tail risk. Based on expected robustness and riskiness of selected premiums as described in the body of research, they conclude that:

- Fundamental premiums are typically robust, supported by both risk-based economic theory and empirical evidence across asset classes and timeframes. Within this category:

- Quality (based on firm accounting data such as profitability, earnings and indebtedness) is an example of a defensive fundamental premium. Quality metrics apply to both stocks and bonds.

- Carry (economic rent for bearing tail risk) is an example of an offensive fundamental premium. Capture of this premium typically involves buying assets with relatively high yields and selling those with relatively low yields, with risk dependent on hedge efficiency and therefore on changes in correlation between long and short sides. Short volatility is a one-sided example of carry.

- Behavioral premiums derive from (1) irrationality of some investors and (2) constraints on rational investors. Within this category:

- Trend following/momentum is an example of a defensive behavioral premium, perhaps driven by slow reaction to economic and financial news/data.

- Value (based on mean reversion of abnormal valuation metrics) is an example of an offensive behavioral premium. This premium differs from quality in that value stocks may be cheap for a good fundamental reason. Momentum and value tend to be complementary, with the former generally evolving more rapidly than the latter.

- Other examples of offensive behavioral premiums are low volatility and low beta, both involving avoidance of explicit leverage in favor or implicit leverage.

- Structural premiums derive from market structure/liquidity imbalances such as created by seasonal asset flows or regulatory changes. Within this category:

- Examples of defensive structural premiums are turn-of-the-month (driven by institutional investment flows) and roll return. Typically, these strategies are long-only and fully invested only during flow intervals. In practice, traders tend to extinguish such premiums.

- Examples of offensive structural premiums are the size effect, insurance industry rebalancings, trades countering large commodity hedgers and index additions/deletions.

The following figure, taken from the paper, summarizes the proposed premium framework.

In summary, investors may find the proposed anomaly premium framework helpful in diversifying complex portfolios across opportunities of different expected robustness and risk.

Cautions regarding conclusions include:

- The paper is conceptual. The authors do not speculate on optimal premium mixes or returns.

- Many investors do not hold portfolios large enough to diversify across many premiums.

- Many investors do not have the capability to construct/implement portfolios exploiting some premiums and would bear fees for delegating these tasks to an investment/fund manager.