Does appearance-based masculinity predict hedge fund manager performance? In their January 2018 paper entitled “Do Alpha Males Deliver Alpha? Testosterone and Hedge Funds”, Yan Lu and Melvyn Teo use facial width-to-height ratio (fWHR) as a positively related proxy for testosterone level to investigate the relationship between male hedge fund manager testosterone level and hedge fund performance. They each year in January sort hedge funds into tenths (deciles) based on fund manager fWHR and then measure the performance of these decile portfolios over the following year. Their main performance metric is 7-factor hedge fund alpha, which corrects for seven risks proxied by: (1) S&P 500 Index excess return; (2) difference between Russell 2000 Index and S&P 500 Index returns; (3) 10-year U.S. Treasury note (T-note) yield, adjusted for duration, minus 3-month U.S. Treasury bill yield; (4) change in spread between Moody’s BAA bond and T-note, adjusted for duration; and, (5-7) excess returns on straddle options portfolios for currencies, commodities and bonds constructed to replicate trend-following strategies in these asset classes. They collect 3,228 hedge fund manager photographs via Google image searches, choosing the best for each manager based on resolution, degree of forward facing and neutrality of expression. They use these photographs to measure fWHR as the distance between the two zygions (width) relative to the distance between the upper lip and the midpoint of the inner ends of the eyebrows (height). Using these fWHRs, monthly net-of-fee returns and assets under management of 3,868 associated live and dead hedge funds, and monthly risk factor values during January 1994 through December 2015, they find that:

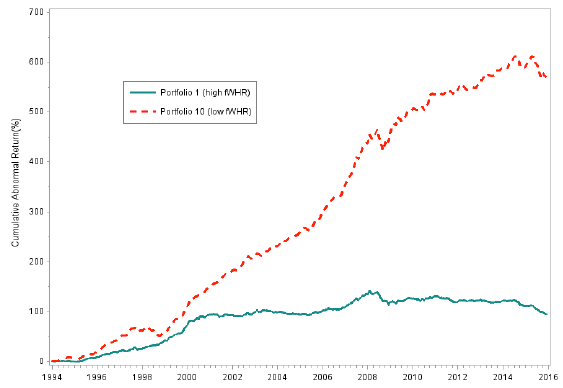

- Hedge funds managed by individuals in the highest fWHR decile underperform funds managed by those in the lowest by (see the chart below):

- Annual raw average 5.81%.

- Annual 7-factor alpha 5.80%.

- Annualized Sharpe ratio 0.62.

- Results are robust to sample selection parameters, fund size, fund age, share redemption restrictions, manager incentives, return smoothing, backfill bias, manager manipulation of returns, manager marital status and manager age .

- High-testosterone managers are more likely to terminate funds, disclose violations on Form ADVs and exhibit high operational risk.

- Underperformance of high-testosterone managers appears to derive from preference for lottery-like stocks and reluctance to sell loser stocks.

- Hedge fund investors appear to self-select fund managers congruent with their own testosterone levels.

The following chart, taken from the paper, compares gross cumulative abnormal returns (7-factor alphas) for funds managed by the decile of managers with the highest (Portfolio 1) and lowest (Portfolio 10) testosterone levels as measured by fWHR. Results indicate that the high-testosterone portfolio consistently underperforms the low-testosterone fund portfolio over the sample period.

In summary, evidence indicates that hedge fund investors should prefer funds managed by males with relatively long, thin faces.

Cautions regarding findings include:

- The study does not demonstrate that hedge fund investors can reliably exploit findings out-of-sample. Specifically:

- The analysis is in-sample, based on photographs available at the time of the study and not photographs available in real time.

- Investors generally cannot hold and trade many hedge funds to assure capture of decile averages.

- There is judgment in photograph selection when multiple photographs of a manager are available, and photographs may be small (amplifying measurement errors).

- The sample does not include women, likely because there are relatively few female hedge fund managers.