How do fine wines fare recently against stocks as investment vehicles? In the June 2012 version of their paper entitled “A Study of the Evolution of High-End Wines in Switzerland”, Philippe Masset, Jean-Philippe Weisskopf and Vincent Deboccard construct the recent evolution of fine wine prices in the Swiss market (among the world’s largest for fine wines). They define fine wine as “wine with a secondary market value, ability to improve in a bottle, a strong track record [and] critical acclaim.” They compare performances of an index comprised of 225 fine wines (post-1969 vintages, mostly red) and a high-end (first growth) fine wine segment to those of equity market indexes. Using secondary market prices from a leading wine auction house in Switzerland during March 2002 through December 2011 (22,711 observations from 46 auctions), and contemporaneous stock index returns, they find that:

- In general, fine wines outperform stocks over the sample period, as follows:

- The average annual gross return of the fine wine index is 0.33% (in Swiss francs), compared to -4.64% for the STOXX Europe 50 index. Respective annual volatilities are 11.0% and 20.6%. High-end (first growth) wines outperform, with average annual gross return 5.05% and annual volatility 18%.

- Annual gross Sharpe ratios are -0.07 for the wine index, 0.23 for the first growth segment and -0.38 for the STOXX Europe 50 index.

- Maximum annual drawdowns are -22.2% for the wine index, -25.9% for the first growth segment and -54.9% for the STOXX Europe 50 index.

- The correlation of annual returns between the fine wine index (first growth segment) and equity markets is 0.61 (0.46).

- Trading wine involves substantial transaction costs (auction house charges of about 20% to 25%).

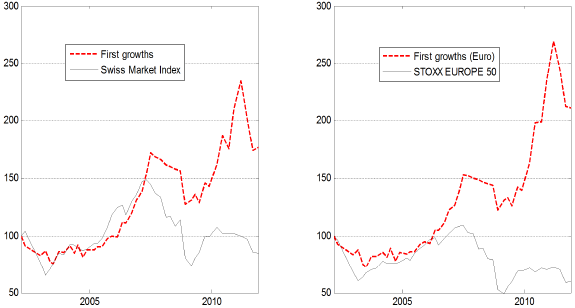

The following charts, taken from the paper, compare evolutions of gross auction prices for the high-end (first growth) wine segment in Swiss francs versus the Swiss equity market (left chart) and in euros versus STOXX Europe 50 index (right chart) over the sample period. Results suggest that premium wine values are more resilient during crisis, with potential to beat stocks during bull markets.

In summary, recent evidence suggests that fine wine may offer both attractive performance and diversification of traditional investments.

Cautions regarding findings include:

- As noted in the paper, wine trading frictions are high, such that very long holding periods are critical to attractive performance.

- The definition of fine wine appears somewhat subjective and perhaps circularly (retrospectively) connected with price appreciation. In other words, investors may not be able to specify fine wines accurately in advance of a long holding period.

- One decade is a short sample period for assessing investment performance.

- Segmentation of the wine market introduces data snooping bias into the performance of the best segment.

- As noted in the paper, performance in euros is stronger than that in Swiss francs by about 1.5% per year.