How does wine perform as a long-term investment? In the September 2013 version of their paper entitled “The Price of Wine”, Elroy Dimson, Peter Rousseau and Christophe Spaenjers examine the performance of wine as a long-term investment, with focus on the impact of aging. They employ long price histories for five long-established Bordeaux wines constructed from auction and dealer prices. They account for vintage effects via annual data on production yields and weather. They also consider the costs of storage and insurance. They calculate real returns based on UK inflation. Using 36,271 prices for 9,492 combinations of sale year, chateau, vintage and transaction type (auction of dealer) during 1900 through 2012, they find that:

- Prices of high-quality vintages rise strongly for the first few decades and then stabilize until the wines become antiques, after which prices again rise. For low-quality vintages, prices are relatively flat for the first few years but then rise in a near-linear fashion.

- Overall, wine generates an average annualized (geometric mean) gross real return of 5.3% over the entire sample period. Costs of storage and insurance reduce this real return to 4.1% (8.2% nominal). The inflation-adjusted price of wine is flat over the first third of the 20th century, exhibits a bubble during World War II and appreciates substantially since.

- Because of the persistent popularity of the wines evaluated (survivorship bias), results are likely an upper bound on the long-term investment performance of wine in general. However, returns on other types of wine are not dramatically lower than the Bordeaux wines over the last few decades.

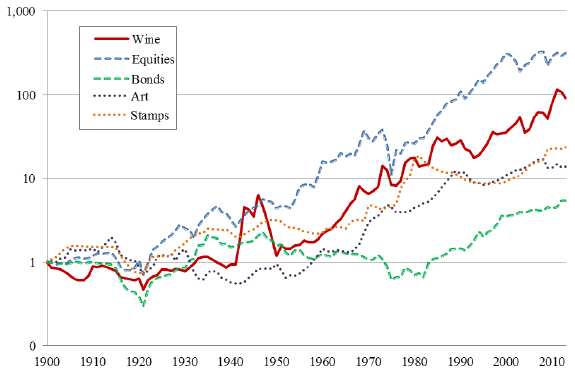

- Over the entire sample period, wine net of storage and insurance costs underperforms equities (gross annualized real return 5.2%) but outperforms UK bonds, art, and stamps before trading frictions (see the chart below).

- Accounting for trading frictions would materially lower the return on wine compared to equities and bonds. For example, via auction at Christie’s London at the end of 2012, a seller receives only about 75% of the sale price. Buyers and sellers may incur additional costs of transportation, handling and administration in changing ownership.

- Wine and equity returns are positively correlated.

The following chart, taken from the paper, compares on a logarithmic scale gross real (UK) price indexes for wine (accounting for storage and insurance) and several other assets during 1900 through 2012. All indexes are set to one at the beginning of 1900. The annualized gross real return is 4.1% for wine, compared to 5.2%, 2.4% and 2.8% for equities, art and stamps, respectively.

In summary, evidence indicates that wine competes well as a long-term investment with government bonds, art and stamps, but not stocks.

Cautions regarding findings include:

- As noted in the paper, the reported returns are gross of trading frictions, which are much greater for wines than stocks and bonds.

- As noted in the paper, the survivorship bias associated with focusing on selected “high-quality” wines with long histories may be material.

- Acquiring and maintaining an inventory of wines representative of the index used in the study is beyond the reach of most investors.

See also “Invest in Wine?” for a shorter-term analysis and “Long-term Performance of Aesthetic Investments” for details on long-term returns for art and stamps.