Are high-grade diamonds competitive with conventional asset classes as investments? In his April 2013 paper entitled “The Returns on Investment Grade Diamonds”, Luc Renneboog examines secondary market returns and risks of investment grade gems (white diamonds, colored diamonds and other gems such as sapphires, rubies, and emeralds). He compares their investment performance metrics to those of stocks, corporate and government bonds, gold and real estate. He ignores trading frictions. Using data for 4,750 transactions at gem auctions during 1999 through 2012, he finds that:

- Physical characteristics (carat, color, clarity and cut) largely determine the prices of investment grade diamonds, less so for colored diamonds and other gems. However, the return premium for top-quality gems is modest.

- Over the sample period, the gross compound annual nominal (real) returns for white and colored diamonds in U.S. dollars are 8.1% and 7.4% (5.5% and 4.8%), respectively. The return for rubies, emeralds and sapphires is lower at 4.5% (2.1%). Comparable returns in euros are somewhat lower.

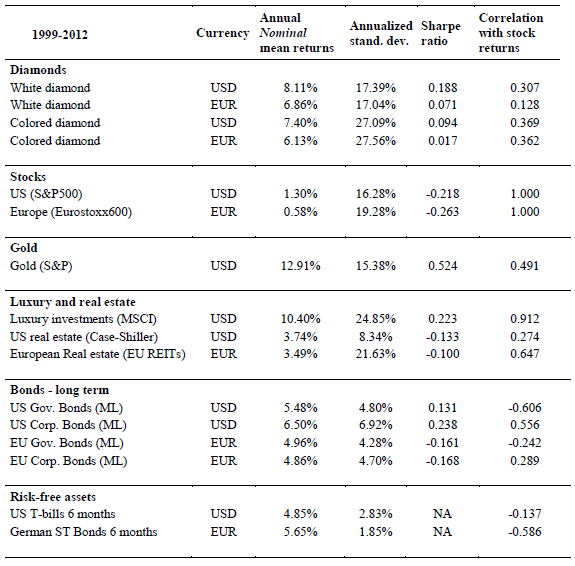

- Based on gross returns over the sample period (see the table below), white and colored diamonds outperform U.S. and European stock markets, U.S. and European real estate, U.S. government bonds and European government and corporate bonds, but not gold. The Sharpe ratio of white diamonds is competitive with those of U.S. government and corporate bonds.

- While gross return correlations between diamonds and global equities are positive (see the table below), supporting belief in a stock market wealth effect, diamonds still have some diversification value with respect to stocks.

The following table, taken from the paper, summarizes gross nominal return statistics for white and colored diamonds, various financial assets, real estate and gold based on semiannual returns during 1999 through 2012. Gross annual returns are compound (geometric mean). The table also shows correlations of returns for these asset classes with those of the global stock market.

Results show that diamonds are a competitive investment asset class on a gross basis. However, gems are relatively illiquid, with much higher trading frictions than financial assets.

In summary, evidence from a short sample period suggests that gross investment returns for high-grade diamonds are competitive with those of other asset classes.

Cautions regarding findings include:

- The sample period is very short for estimation of annualized asset class investment performance.

- As footnoted in the paper, returns are gross. Including trading frictions, which are very high for aesthetic assets, would materially reduce the returns reported for gems.

- Achieving diversification within a portfolio of gems may be problematic due to high unit costs.

- Reported returns for asset classes derive from indexes, not tradable assets. Including the costs of creating liquid, tradable assets from these indexes (administrative/management fees and trading frictions) would lower these returns.

See also the closely related “Return on Gems” and “Diamonds as an Alternative Investment”.