What asset classes offer the best performance during episodes of high and rising inflation? In their March 2021 paper entitled “The Best Strategies for Inflationary Times”, Henry Neville, Teun Draaisma, Ben Funnell, Campbell Harvey and Otto Van Hemert analyze performances of passive and active strategies across various asset classes during inflationary episodes in the U.S., U.K., and Japan over the past 95 years. They define inflationary regimes as follows:

- An episode begins when annual change in headline consumer price index (CPI) rises to 5% or higher.

- An episode ends when annual change falls below 50% of its trailing 24-month peak.

- Alternatively, an episode begins when annual change in CPI is above 2% but has fallen to less than 50% of its trailing 24-month peak, and then rises to at least 5%.

They exclude episodes shorter than six months. They also analyze alternative asset classes such as fine art and discuss crypto-assets as a potential inflation hedge. Using monthly CPI and various asset class returns in the U.S., UK and Japan during 1926 through 2020, they find that:

- As specified, there are eight U.S. inflation episodes during the sample period, ranging in duration from seven months (Aug 1950 – Feb 1951) to 48 months (Feb 1966 – Jan 1970). There are 34 total episodes across U.S., UK and Japan.

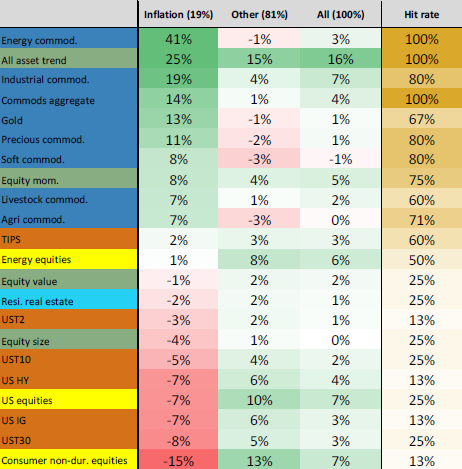

- Both stocks and bonds perform poorly on average during inflation episodes, compounding the challenge for a conventional 60-40 investor (see the table below).

- No equity sector offers significant protection against inflation episodes. Best is the energy sector, which is on average little better than flat in real terms.

- Treasury Inflation-Protected Securities (TIPS) offer similar positive average real returns during both inflationary episodes and other conditions.

- Commodities offer much higher average real returns during inflation episodes than at other times. This effect is most closely linked to U.S. inflation and is particularly strong when the U.S., UK and Japan experience inflation simultaneously.

- Cross-sectional stock momentum is the best equity factor for inflation episodes, with 8% average annual real return versus 4% in other times. Performance of the equity value factor is mixed. Time series (intrinsic or absolute) momentum performs well during inflation episodes across asset classes, most strongly for bonds and commodities.

- Residential real estate and collectibles such as art, wine and stamps on average hold their value during inflation episodes, but significantly lag commodities.

- The correlation of U.S. equity and bitcoin returns suggests that bitcoin may not deliver positive real returns during inflation episodes.

The following table, extracted from the paper, summarizes average real annualized returns of various asset classes/subclasses during U.S. inflation episodes, at other times and over the full sample period. Hit rate indicates the percentage of the eight inflation episodes during which the class has a positive return. During inflation episodes, commodities and trend strategies perform best, and equities and government bonds perform worst.

In summary, evidence indicates that commodities and trend strategies perform well, and equities and government bonds perform poorly, during inflation episodes.

Cautions regarding findings include:

- Eight U.S. and 34 combined inflation episodes are small samples for confident inference.

- The available bitcoin sample is suspect for inference about its behavior during inflation episodes.

- The residential real estate return likely does not account for the net financial benefit of living in the house.

For related research, see results of this search.