A subscriber requested an assessment of U.S. federal capital gains tax impacts on the Simple Asset Class ETF Value Strategy (SACEVS), the Simple Asset Class ETF Momentum Strategy (SACEMS) and combinations of the two for investors with taxable accounts. Modeling such impacts is difficult due to complexity of the tax code and its highly idiosyncratic effects across individual taxpayers. To get a rough idea of federal tax impacts, we use annual (calendar year) data and make the following (close to worst case for SACEVS and SACEMS) simplifying assumptions:

- Federal taxes (income and capital gain) are per 2020 brackets.

- All SACEVS/SACEMS gains are short-term, treated as income at the marginal rate (some years not true for SACEVS, especially Best Value; generally true for SACEMS).

- All taxes for SACEVS and SACEMS are at marginal rates, debited annually, with losses carried forward and offsetting future gains until exhausted.

- Benchmarks are (1) buying and holding SPDR S&P 500 (SPY) and (2) a monthly rebalanced 60% SPY, 40% iShares 20+ Year Treasury Bond (TLT) portfolio. Benchmarks are essentially buy-and-hold, the latter because monthly deviations from target allocations are usually modest, with long-term capital gain tax debited only at the end of the sample period.

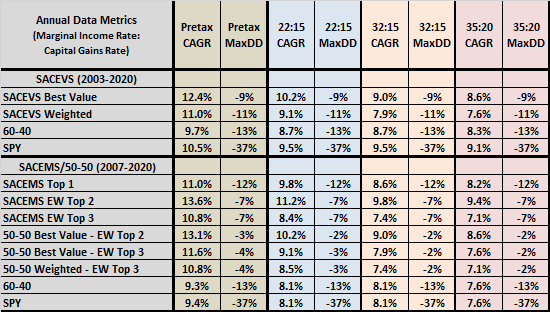

We focus on compound annual growth rate (CAGR) and maximum drawdown (MaxDD) as essential performance metrics. Using annual gross returns for SACEVS and the two benchmarks since 2003 and for SACEMS and SACEVS/SACEMS combinations since 2007, all through 2020, we find that:

The following table summarizes impacts of U.S. federal taxes on each portfolio over available sample periods for three combinations of marginal tax rates: (1) income 22% and long-term capital gain 15% (22:15), (2) 32:15 and (3) 35:20. Income breakpoints are different for income tax and capital gain tax brackets, but these three combinations seem most likely for moderately well-off investors. Notable points are:

- The higher the marginal brackets, the greater the tax penalty for SACEMS and SACEVS relative to the penalty for the benchmarks.

- The relatively deep MaxDD is off-putting for SPY buy-and-hold.

In summary, investors following SACEMS/SACEVS in taxable accounts should consider the disparate impacts of federal taxes on active and passive portfolios.

Cautions regarding finding include:

- As noted above, the modeling approach is:

- Somewhat biased against SACEVS Best Value and Weighted.

- Slightly biased against SACEMS.

- A little biased in favor of 60-40.

- Slightly biased in favor of SPY buy-and-hold.

- Individual taxpayer situations may perturb assumptions, as would changes in federal tax rates.

- Incremental state and local taxes may also affect findings.

- There are also trading frictions involved in portfolio maintenance, not modeled above, which vary across alternative strategies.