Is it possible to achieve an attractive return with very low risk from a small universe of exchange-traded funds (ETF)? In the January 2021 revision of his paper entitled “Lazy Momentum with Growth-Trend Timing: Resilient Asset Allocation (RAA)”, Wouter Keller constructs and tests the Resilient Asset Allocation (RAA) strategy as a more aggressive version of the Lethargic Asset Allocation (LAA) strategy. LAA switches between risky (equal-weighted QQQ, IWD, IEF and GLD) and defensive (equal-weighted IWD, GLD, SHY and IEF) portfolios based on trend in the U.S. unemployment rate (bullish when above and bearish when below its 12-month simple moving average). RAA alters LAA in three ways:

- Changes the risky portfolio to an All Weather-like portfolio, with five equal-weighted assets (QQQ, IWN, IEF, TLT, GLD) instead of four and only two equal-weighted assets (IEF and TLT) as a risk-off portfolio.

- Adds “canary” crash protection from the Defensive Asset Allocation strategy for signaling the market trend with a fast filter (bearish when either or both of VWO or BND turn bad).

- Slows the unemployment rate trend signal, simply comparing recent unemployment rate with that of a year ago.

RAA is in the defensive portfolio only when both the canary and unemployment rate trend signals are bearish. Using a combination of modeled and (as available) actual monthly price data for the specified ETFs during December 1970 through November 2020, he finds that:

- RAA generally achieves attractive returns over the full sample period and different subperiods with very low risk (see the table below).

- RAA is in defensive posture only 15% of the time over the full sample period.

- RAA has low portfolio maintenance frictions, trading on average only once per year.

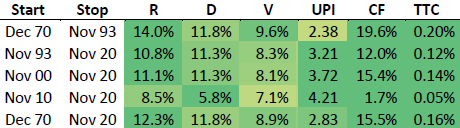

The following table, extracted from the paper, summarizes RAA net performance for the full sample period and four subperiods based on monthly data. The December 1970 through November 1993 subperiod is used for parameter optimization. Performance variables are:

- R – compound annual growth rate (CAGR).

- D – maximum drawdown.

- V – annual volatility.

- UPI – Ulcer Performance Index (similar to Sharpe ratio but with Ulcer drawdown in place of volatility).

- CF – average percentage of the portfolio in the defensive portfolio.

- TTC – Total Transaction Cost (based on 0.1% one-way frictions).

Volatilities are very low, maximum drawdowns are very shallow and frictions are low for the full sample period and all subperiods. CAGRs outside the optimization subperiod are materially lower than the optimized return, especially for the most recent subperiod when all ETFs are explicitly available.

In summary, evidence indicates that a carefully crafted, crash-protected portfolio of a few ETFs may be able to achieve an attractive return at low risk.

Cautions regarding findings include:

- Most of historical dataset is modeled, such that prices are approximations and cannot account for any market reactions to trading of the assets.

- Assumed rebalancing frictions (0.1% one-way) are likely much lower than could have been achieved for much of the sample period, but are reasonable for the most recent subperiod. Fund manager portfolio maintenance costs would have been much higher for most of the sample period than current costs.

- Reuse of data across multiple strategies and strategy variations introduces data snooping bias and degrades the value of “out-of-sample” testing. In other words, reusing “out-of-sample” data throughout an iterative strategy exploration program renders the data largely in-sample. Increasing strategist familiarity with the full dataset, and strategy complexity, exacerbate this concern.