Intangible assets derive largely from investments in employees, brand and knowledge that are expensed rather than booked. Despite large and growing importance of intangible assets, traditional measures of firm value ignore them. Are firm value assessments therefore defective? In their October 2020 paper entitled “Intangible Value”, Andrea Eisfeldt, Edward Kim and Dimitris Papanikolaou evaluate a value factor that includes intangible assets in book equity for each firm (HMLINT) following exactly the methodology used to construct the widely accepted Fama-French value factor (HMLFF). They measure intangible assets based on flows of Selling, General, and Administrative (SG&A) expenses. Using firm accounting data and associated monthly stock returns and Fama-French 5-factor model data for a broad sample of U.S. stocks during January 1975 through December 2018, they find that:

- HMLINT:

- Has 0.81 correlation of monthly gross returns with HMLFF.

- Prices test assets more accurately than HMLFF.

- Substantially outperforms HMLFF (see the chart below). Average annualized gross return to a portfolio that is each month long HMLINT and short HMLFF is 2.4% with standard deviation 5.9%.

- HMLINT outperformance holds over the full sample period and subperiods, and is pronounced in recent years when HMLFF is particularly weak (consistent with growing importance of intangible assets).

- More concentrated measures of intangible value also price test assets better than HMLFF.

- HMLINT sorts stocks more effectively on productivity, profitability, financial soundness and other valuation ratios such as price-to-earnings and price-to-sales than does HMLFF.

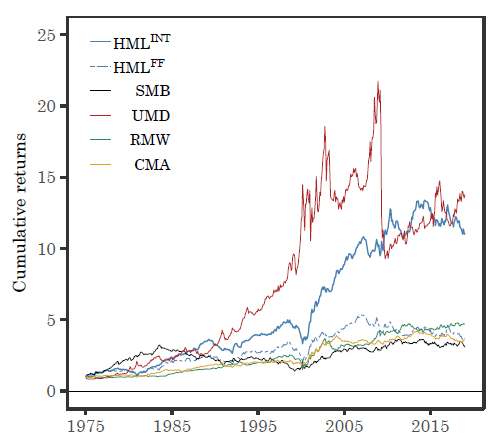

The following chart, taken from the paper, tracks cumulative gross returns for six equity factors that are each month long (short, or minus) stocks with high (low) expected returns over the full sample period:

- HMLINT – high minus low book-to-market ratios, with book value including intangible assets.

- HMLFF – high minus low book-to-market ratios, with book value excluding intangible assets.

- SMB – small minus big firm market capitalizations.

- UMD – up minus down recent past stock returns.

- RMW – robust minus weak recent firm profitabilities.

- CMA – conservative minus aggressive recent firm capital investments.

Results show that HMLINT strongly outperforms HMLFF and that HMLINT is attractive compared to other 5-factor model factors.

In summary, evidence indicates that including intangible assets in book value substantially improves accuracy and usefulness of the Fama-French 5-factor model of stock returns.

Cautions regarding findings include:

- Reported performance data are gross, not net. Accounting for frictions of periodic factor portfolio reformation and shorting costs would reduce all returns. Shorting may not always be feasible as assumed. Different factors bear different levels of reformation frictions.

- The methodology is beyond the reach of most investors, who would bear fees for delegating to a fund manager.

See results of this search for recent relevant research on intangible assets.