Do stocks with high borrowing costs (loan fees) exhibit predictably low short-term returns? In their November 2020 paper entitled “Borrowing Fees and Expected Stock Returns”, Kaitlin Hendrix and Gavin Crabb explore whether stock loan fees contain reliable and useful information about short-term stock returns worldwide. To isolate borrowing activity most likely related to short selling, they require: (1) no naked short selling allowed in the market; (2) covered short selling allowed throughout the sample period; and, (3) low likelihood of lending securities around dividends for tax reasons. They focus on stocks that are expensive to borrow, small-capitalization stocks with loan fee thresholds determined country by country. They each day form market capitalization-weighted portfolios of stocks not on loan, stocks with low loan fees and stocks with high loan fees based on lending activity the prior trading day. They also consider lending activity the prior three or five days, with not-on-loan and high-fee stocks meeting requirements each of the three or five days. Using proprietary mutual fund stock loan data from Dimensional Fund Advisors across 14 developed and emerging markets during 2011 through 2017 and associated daily stock returns through 2018, they find that:

- For small (large) stocks, average annualized loan fees vary across regions from 0.37% in the U.S. (0.15% in the U.S.) to 6.93% in Turkey (3.21% in Malaysia).

- Average daily numbers of high-fee small stocks are 1,442, 1,389 and 1,350 for the 1-day, 3-day and 5-day lookback intervals, respectively.

- Over the full sample period for all countries, average annualized gross returns for the 1-day lookback interval among small stocks are:

- Not on loan: 8.76%.

- On loan with low fee: 8.71%.

- On loan with high fee: -0.09%.

- Findings are robust, as follows:

- In individual countries, underperformance of small high-fee stocks relative to small not-on-loan stocks ranges from gross annualized 1.2% in Turkey to over 10% in the U.S., Canada, France and Singapore.

- Across all countries in each year during the sample period, high-fee stocks on average underperform not-on-loan stocks.

- Underperformance of high-fee stocks persists throughout the week after portfolio formation.

- Results hold for portfolios using 3-day and 5-day lookback intervals.

- Stocks with high fees at the beginning and the end of a year on average strongly underperform stocks with high fees only at the beginning throughout the measurement year (see the charts below). In fact, stocks that are high-fee at portfolio formation but not at the end of the year perform about the same as stocks not-on-loan during that year, suggesting that stocks with persistently high fees fully account for above effects.

- The percentage of stocks that remain high-fee after portfolio formation falls to 92% after five trading days to 82% after 20, 61% after 120 days and 49% after one year. While persistence of high loan fees is not very predictable, stocks with lower market capitalizations, higher prices and lower profitabilities are more likely to remain high-fee after a year.

- The daily rebalanced test portfolios have fairly high turnover and shorting the high-fee portfolio would naturally involve high costs, such that net findings would differ substantially from gross findings.

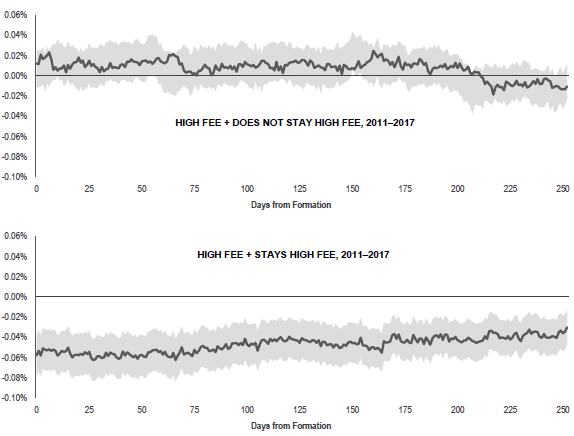

The following charts, taken from the paper, compare the average daily gross returns of two high-fee sets of small stocks relative to not-on-loan stocks during the year after portfolio formation:

- Those on loan with a high fee at the beginning of the year, but not the end (upper chart).

- Those on loan with a high fee at both the beginning and the end of the year (lower chart).

Dark lines are average daily gross returns, and shaded areas span two standard errors around the daily average. Results show that the second set accounts for underperformance of high-fee stocks. However, persistence of high-fee status over a year is not very predictable.

In summary, evidence indicates that there is reliable information in stock loan fees about subsequent stock returns that concentrates among small stocks with long-term high-fee persistence, but exploitation frictions are high and persistence of high-fee status is not very predictable.

Cautions regarding findings include:

- As noted, results do not account for daily portfolio reformation frictions, data costs (if even available) or shorting costs. Heavily shorted stocks may have unusually wide bid-ask spreads.

- As noted, identification of the stocks with most dramatic underperformance is not very reliable.

- Even with the data, the methodology is beyond the reach of most investors, who would bear fees for delegating to a fund manager.

See also “Stock Loan Fee as Return Predictor” and “Shorting Fee as a Stock Return Predictor”.