Does the U.S. stock market respond predictably to simultaneous earnings announcements of attention-grabbing companies? In their September 2020 paper entitled “Famous Firms, Earnings Clusters, and the Stock Market”, Yixin Chen, Randolph Cohen and Zixuan Wang examine U.S. stock market (E-mini S&P 500 futures) responses to earnings announcement clusters (EAC) comprised of high-attention firms. They focus on the three most prominent pre-open (AM) and three most prominent post-close (PM) EACs in each of January, April, July and October, with each announcement weighted for prominence by associated total number of Dow Jones earnings news articles during the prior calendar year. Using earnings announcements and daily prices for S&P 500 components and minute-by-minute E-mini S&P 500 futures returns during 1999-2018, and associated earnings news articles during 1998-2018, they find that:

- Market return is on average strong during the close-to-close 24 hours before prominent PM EACs as modeled.

- The market rises an average 0.34% on these days, compared to 0.02% for a typical market day, with normal volatility and annualized Sharpe ratio 4.5.

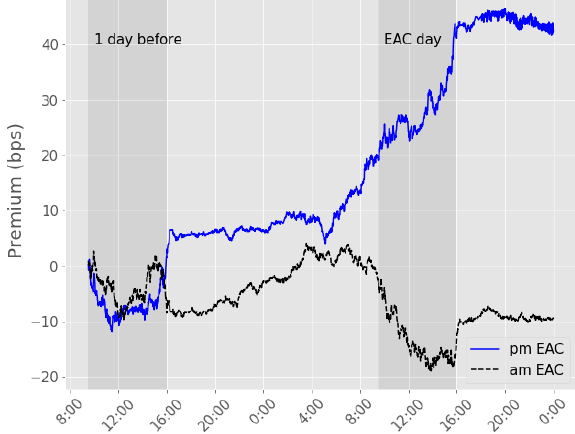

- 0.11% of this rise comes the evening before, and 0.23% comes during the trading day before announcement (see the chart below).

- Average stock market return increases systematically with EAC news-weighted importance.

- Individual stocks within EACs perform even better, with average return 0.61% during the pre-release day, but the rest of the market still gains nearly 0.34%.

- The effect is weaker but remains significant when defining EACs based simply on number of announcements or total market capitalization of firms announcing.

- There is little or no correlation between market performance pre-announcement and post-announcement, arguing against information leaks as a cause of the anomaly.

- Confoundingly, the anomaly exists only for PM EACs and not for AM EACs, which comprise about two thirds of the overall EAC sample.

- The most likely explanation is that the combination of a short attention period and shorting constraints turns differences of opinion into positive returns, and that attention for PM EACs is much stronger than that for AM EACs.

The following chart, taken from the paper, compares average cumulative excess returns (relative to U.S. Treasury bill yield) of E-mini S&P 500 futures around PM EACs and AM EACs separately. PM EACs have a strong pre-announcement return, but AM EACs do not.

In summary, evidence indicates that holding the U.S. stock market for just three days in each quarter (12 days a year, based on the most prominent PM EACs) captures nearly two thirds of annual market excess return, while bearing a small fraction of annual market volatility.

Cautions regarding findings include:

- The sample period (20 years) is not long for assessment of annual outperformance of PM EACs in terms of variety of market conditions.

- Return calculations are gross, not net. Accounting for costs of buying and selling E-minis would modestly reduce returns.

- The news-weighted methodology is beyond the reach of most investors, who would bear fees for delegating to a fund manager.

For other research on earnings announcements, see results of this search.