Benford’s law states that the probability of the value of the first digit in many naturally occurring samples of numbers, including asset prices, varies inversely with digit magnitude. For example, the number 1 (9) appears as the leading digit about 30% (less than 5%) of the time. For asset prices, deviations from this law typically indicate some kind of fraud. In his September 2020 paper entitled “To the Moon: A History of Bitcoin Price Manipulation”, Timothy Peterson applies Benford’s law to daily bitcoin prices over a long sample and by calendar year to identify price manipulations. He requires that each bin [0 through 9] in the price distribution histogram have at least eight observations. If this condition is not met for the first digit, he relies on the second digit. If not for the first and second digits, he relies on the third digit. To rule out speculative mania as the cause of unusual price activity, he uses daily ratios of price to three fundamental network size and activity metrics: (1) active addresses, (2) non-zero balance addresses and (3) transaction counts. Using daily closing Bitcoin price and activity data during July 2010 through May 2020, he finds that:

- Fraudulent manipulation of bitcoin price over the full sample is near certain.

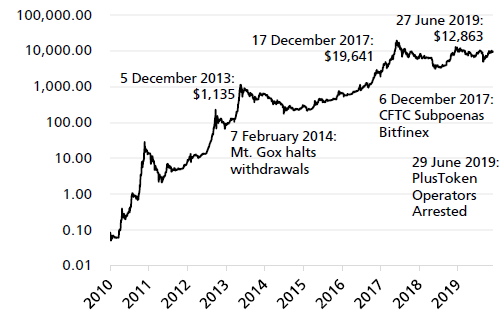

- There is 95% confidence of fraudulent manipulation of bitcoin price during each of 2013, 2017 and 2019. Visual inspection of price graph (see the chart below) suggests that these manipulations occur during:

- November 2013 – February 2014 (theft of coins from Mt. Gox cryptocurrency exchange and subsequent exchange liquidation).

- August 2017 – November 2018 (alleged scheme by Tether and Bitfinex to inflate bitcoin price using tokens of questionable value in an attempt to recover from theft of bitcoins on the Bitfinex exchange).

- May 2019 – February 2020 (large volume of fake bitcoin transactions to affect price that are not recorded in the bitcoin blockchain).

- Excluding bitcoin price activity around these three intervals reduces its annualized daily volatility by about 50%, implying that bitcoin’s (manipulated) discount rate is artificially high. Adjusting bitcoin present value to exclude these intervals would increase its value by about 40%.

- Both technical and fundamental efforts to value bitcoin during intervals of manipulation are likely meaningless.

The following logarithmic chart, taken from the paper, summarizes bitcoin price peaks and ends of suspicious activities. Visual inspection suggests the following pattern for manipulative spikes:

- Misappropriation of bitcoins, often due to exchange security breach/theft.

- Reports of suspicious activity reported first by cryptocurrency enthusiasts.

- Bitcoin price appreciation faster than growth in fundamental metrics such as address and transaction counts.

- Collapse in bitcoin price.

In summary, application of Benford’s Law to daily bitcoin price identifies repeated instances of price manipulation, corroborated by intervals of price appreciation outpacing fundamentals, that interfere with accurate bitcoin valuation.

Cautions regarding findings include:

- As noted in the paper, analyses based on Benford’s Law require large datasets, making it difficult to isolate manipulations analytically.

- Since manipulations persist into recent times, investors cannot know whether/when the bitcoin market reliably represents fundamental value.

For other research on bitcoin, see results of this search.