Does the real (inflation-adjusted) price of gold indicate future gold return? If so, what is the current indication? In their August 2020 paper entitled “Gold, the Golden Constant, COVID-19, ‘Massive Passives’ and Déjà Vu”, Claude Erb, Campbell Harvey and Tadas Viskanta examine behavior and implications of real gold price (gold price in U.S. dollars per ounce divided by the U.S. consumer price index) based on the assumption that the main investor interest in gold is as an inflation hedge. Specifically, they look at interactions among gold price, U.S. inflation, real gold price, government bond (10-year U.S. Treasury note) yield, expected U.S. inflation (difference between 10-year Treasury note and 10-year inflation protected Treasury yields) and gold demand as measured by holdings of the top two gold exchange-traded funds (ETF). Using data for these variables as available during January 1975 (inception of gold futures trading) through July 2020, they find that:

- High real gold price historically occurs during times of high expected inflation. Five years after the real price peaks in January 1980 and August 2011 nominal (real) gold return is -55% (-67%) and -28% (-33%), respectively.

- More recently, there is a strong positive (R-squared statistic 0.89) relationship between major gold ETF holdings and real gold price. This financialization of gold ownership could drive higher peaks and lower troughs for real gold price.

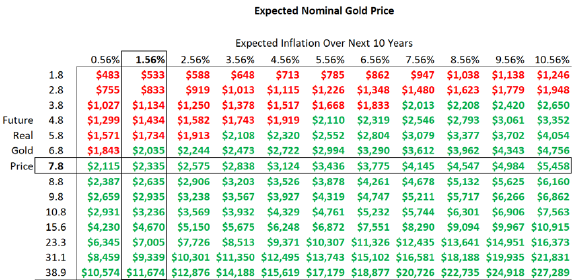

- Currently, real gold price is almost as high as in January 1980 and August 2011, suggesting that it is now an expensive inflation hedge with low expected return (see the table below).

- At the end of July 2020, expected annualized inflation over the next 10 years is 1.56% and real gold price is 7.8, compared to historical average 3.8.

- If the inflation forecast is accurate and real gold price stays at 7.8 (drops to 3.8), expected nominal gold price in 10 years is $2335 ($1,134).

The following table, taken from the paper, projects nominal gold price in 10 years based on two inputs: (1) expected annualized inflation over the next 10 years; and, (2) expected real gold price at the end of 10 years. For example, if real gold price stays at 7.8 for 10 years and the 10-year annualized inflation rate is 1.56% as currently expected, then the nominal price of gold in 10 years should be $2,335. If real gold price declines to its historical average 3.8 and annualized inflation is in the range 7%-8%, nominal gold price in 10 years should be about its current price.

In summary, viewing gold as predominately an inflation hedge offers a means to estimate its future value/return based on beliefs about a “normal” real gold price and future inflation.

Cautions regarding findings include:

- The sample is very short in terms of economic cycles/inflation regimes, making reliability of statistics such as average gold price unreliable.

- The analysis assumes no influence from conditions outside the U.S. or from treatment of gold as a safe haven during crises.

See also “DJIA-Gold Ratio as a Stock Market Indicator” and other results of this search.