Referring to “Chicago Fed NFCI as U.S. Stock Market Predictor”, a subscriber asked whether the Federal Reserve Bank of Chicago’s Adjusted National Financial Conditions Index (ANFCI) may work better as a U.S. stock market predictor. ANFCI “isolates a component of financial conditions uncorrelated with economic conditions to provide an update on financial conditions relative to current economic conditions.” Positive (negative) values of the ANFCI are associated with financial conditions that are tighter (looser) than than those suggested by prevailing macroeconomic conditions, with degree measured in standard deviations from the mean. The Chicago Fed releases ANFCI each week as of Friday on the following Wednesday at 8:30 a.m. ET (or Thursday if Wednesday is a holiday), renormalized such that the full series always has a mean of zero and a standard deviation of one (thereby each week changing past values, perhaps even changing their signs). To investigate its usefulness as a U.S. stock market predictor, we relate ANFCI and changes in ANFCI to future S&P 500 Index returns. Using weekly levels of ANFCI and weekly closes of the S&P 500 Index during January 1971 (limited by ANFCI) through April 2020, we find that:

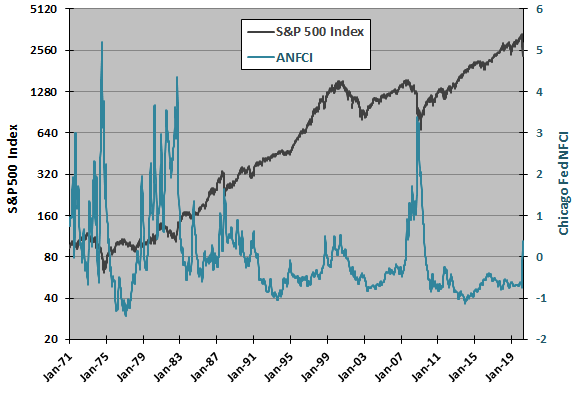

The following chart tracks weekly levels of the S&P 500 Index (on a logarithmic scale) and ANFCI over the available sample period. Visual inspection suggests a negative relationship between the two series, accentuated when ANFCI spikes, but it is not obvious whether one series leads the other. Cumulative effects of weekly renormalizations can be large, undermining use of the series for backtesting.

However, renormalizations should have little effect on past weekly changes in ANFCI, so we focus on relating weekly changes in ANFCI to future weekly stock market returns.

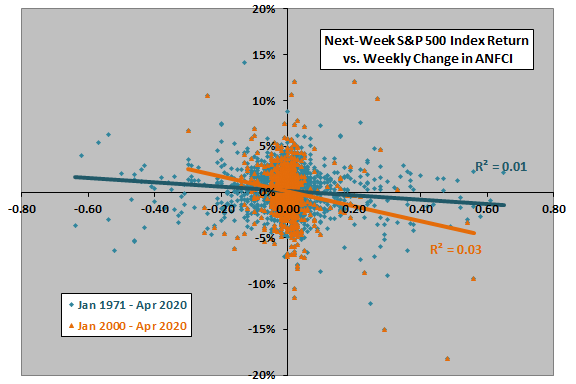

The following scatter plot relates next-week (measured week, Friday close to Friday close) S&P 500 Index return to weekly change in ANFCI over the full sample period and over a subperiod since the beginning of 2000. We ignore stock market returns during two weeks in September 2001 due to market closure. The Pearson correlation over the full sample period is -0.11, confirming a negative relationship, and the R-squared statistic is 0.01, indicating that weekly change in ANFCI explains 1% of variation in next-week stock market return. The relationship is somewhat stronger since the beginning of 2000 (Pearson correlation -0.18), with weekly change in ANFCI explaining about 3% of variation next-week stock market return.

The relationship as presented is not fully exploitable because ANFCI releases occur in the middle of the next-week return measurement interval. Correlations of weekly changes in ANFCI based on lagged release date-to-release date (Wednesday open to Wednesday open) weekly returns are somewhat weaker, -0.08 and -0.13, respectively.

Might the relationship persist over a longer horizon?

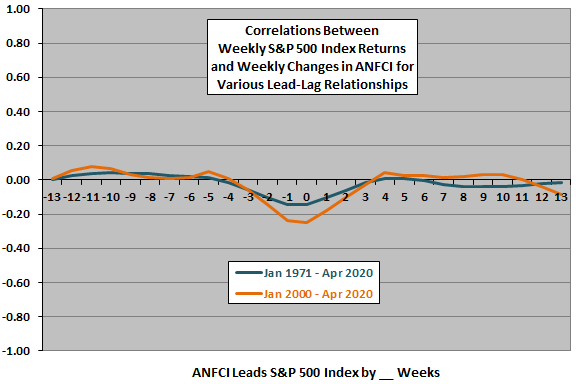

The next chart summarizes Pearson correlations between weekly change in ANFCI and weekly S&P 500 Index return (measured week) for lead-lag relationships ranging from stock market return leads change in ANFCI by 13 weeks (-13) to change in ANFCI leads stock market return by 13 weeks (13) over the full sample period and a subperiod since the beginning of 2000. Results indicate mutual predictive power for the two series, somewhat stronger in recent data. Specifically:

- A relatively strong (weak) U.S. stock market over the past three weeks indicates a decrease (increase) in ANFCI.

- An increase (decrease) in ANFCI indicates a relatively weak (strong) U.S. stock market over the next two weeks.

Results using lagged release date-to-release date S&P 500 Index returns rather than measured week returns are similar, though weaker.

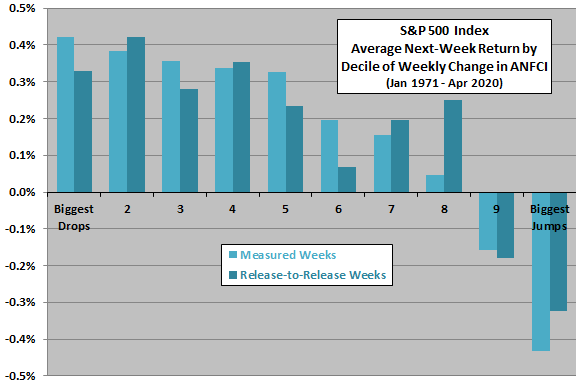

Might there be an important non-linearity in the relationship? To check, we calculate average next-week stock market return by range of changes in ANFCI.

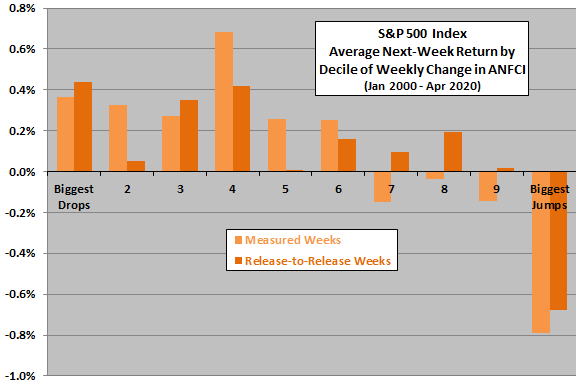

The final two charts summarize average next-week S&P 500 Index returns for both measured weeks and lagged release date-to-release date returns by ranked tenth (decile) of weekly changes in ANFCI over the full sample period (upper chart) and a subperiod since the beginning of 2000 (lower chart). Results consistently suggest that change in ANFCI is a potential crash protection indicator, with the biggest weekly jumps preceding poor average next-week U.S. stock market returns. However, progressions across deciles are not strongly systematic.

In summary, evidence from simple tests suggests that weekly change in ANFCI may be a useful indicator of future U.S. stock market returns, principally by helping to avoid some or most of stock market crashes.

Cautions regarding findings include:

- As noted, continual renormalization of ANCFI each week alters past values and undermines its direct use for backtesting.

- Analyses are in-sample. An investor operating in real time may draw different conclusions at different points during the sample period, though effects are consistent in the recent subsample.

- The very complex and evolving nature (occasional model changes) of ANFCI raises suspicion of data snooping bias in its most recent formulation, such that predictive power of older data is overstated.

- ANFCI did not exist during most of the sample period (data are backfilled), and there is no feedback from the market until 2010.

- Exploitation of weekly data may drive frequent trading and therefore high cumulative trading frictions.

- The analysis does not account for stock dividends.