How should investors think about combining strategies into a broader portfolio that reliably exploits their interactions over time? In the March 2020 version of his paper entitled “Preferred Portfolios: An Improved Blueprint to Construct Multi Strategy Portfolios”, Lars Kestner discusses how to combine individual strategies into a portfolio that performs robustly out-of-sample base on five principles. His objective is to sift data with a systematic process, find small edges and fit them together into a reliable combination of return streams that in aggregate perform well under almost all market conditions. His process employs two sets of building blocks: (1) diverse quantitative strategies clustered into four categories; and, (2) nine asset markets/classes. Based on theoretical considerations and his experience as an investment manager, he concludes that:

- Strategies tend to fade over time as markets adapt to their success. Continual research is key to replenishing a diversified set of strong signals.

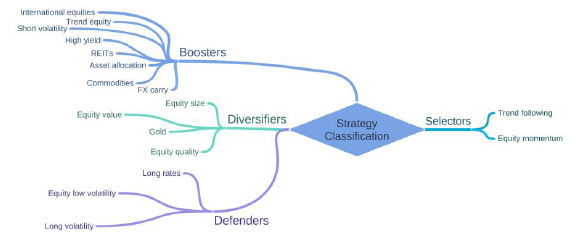

- Strategies fall into four categories: Boosters, Defenders, Diversifiers and Selectors. The categorization process involves calculating for each strategy average 52-week return correlation and standard deviation of 52-week return correlations relative to the broad U.S. stock market (see the figure below).

- Boosters (risk-on) have relatively high positive average correlation and relatively low correlation variability.

- Defenders (risk-off) have relatively low negative average correlation and relatively low correlation variability.

- Diversifiers have relatively low positive or negative average correlation and relatively low correlation variability.

- Selectors have relatively low positive or negative average correlation and relatively high correlation variability.

- The best way to discover low strategy correlations is to consider a broad set of markets: equities, interest rates, currency exchange, credit, commodities, volatility, frontier markets, synthetic markets and private investments.

- Diversification across uncorrelated return streams is the principal value-add of portfolio management. Creating a multi-strategy portfolio involves:

- Setting targets for portfolio expected return and volatility.

- Maximizing expected return, with volatility controls, for each potential component strategy.

- Combining strategies in a way that retains their expected returns while decreasing aggregate risk via uncorrelated movements. The number of truly uncorrelated bets that scale in size is not large, with most of the diversification benefit coming from about 20 strategies.

- Even with such careful construction, bad luck happens. The only way to transform skill reliably into returns is patience.

The following figure, taken from the paper, summarizes parsing of 17 asset classes/strategies into Boosters, Defenders, Diversifiers and Selectors.

In summary, construction of robust investment portfolios involves a continually refreshed and uncorrelated set of quantitative strategies across asset classes, and patience.

Cautions regarding conclusions include:

- The author not devise or test any actual portfolios, and so does not demonstrate empirical success. Implementation costs/frictions may be high.

- Methods described are beyond the reach of most investors, who would bear fees for delegating the work to an investment/fund manager.

Consider also: