What does the U.S. stock market at industry/firm levels say about investor expectations during and after the 2019 coronavirus (COVID-19) pandemic? In the April 2020 update of their paper entitled “Feverish Stock Price Reactions to COVID-19”, Stefano Ramelli and Alexander Wagner examine and interpret industry/firm-level reactions to COVID-19 across three pandemic phases:

- Incubation: January 2-17,

- Outbreak: January 20-February 21,

- Fever: February 24-March 20.

They estimate each stock’s abnormal return during these phases as its 1-factor (market) alpha minus its beta times the market excess return. They estimate alpha and beta via regression of daily excess stock returns on daily excess value-weighted market returns during 2019. They use the yield on 1-month U.S. Treasury bills (T-bill) as the risk-free rate for calculating excess return. Using daily dividend-adjusted stock prices for Russell 3000 stocks (excluding financial stocks for leverage-related analyses), market returns and T-bill yields during December 31, 2018 through March 20, 2020, they find that:

- During the Incubation phase, sophisticated investors start pricing in some effects of COVID-19 based on news out of China.

- During the Outbreak phase, a broader set of investors drive down prices of China-oriented and internationally-oriented stocks, even as the broad market is fairly stable.

- During the Fever phase, the broad market crashes with whipsaws, but:

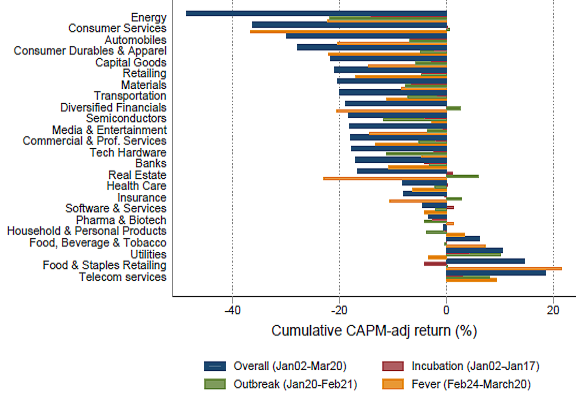

- Performance by industry varies considerably (see the chart below). Telecom services, food and staples, utilities and health care perform relatively well. Energy, consumer services and transportation are big losers.

- At the firm level, investors penalize not only firms trading with China, but also more generally those with international exposure.

- Across industries, investors are increasingly worried about corporate debt and liquidity. Firms with low cash holdings, even those with little or no international exposure, suffer severely. This finding suggests that, in addition to cash flow concerns, investors must be pricing a rising discount rate (higher general risk aversion).

- Post-Fever, Federal Reserve Board and U.S. government actions relieve investor concerns about corporate debt and liquidity, but these concerns remain at high levels.

The following chart, taken from the paper, compares cumulative abnormal returns over the full test period and during each COVID-19 phase by industry. Notable points are:

- Telecom outperforms across phases, as demand for telework skyrockets.

- Food and Staples Retailing is close to market-neutral during Incubation and Outbreak period, but surges in the Fever phase.

- Health Care is strong during Incubation and Outbreak, but crashes in the Fever phase.

- Utilities, which are essentially domestic, gain strongly during Incubation and Outbreak but weaken in the Fever phase.

- Energy, Consumer Services and Automobiles are particularly weak overall. Energy is weak across phases. Consumer Services are market-neutral during Incubation and Outbreak, but crash during the Fever phase.

In summary, evidence suggests that the COVID-19 health crisis morphed into an economic crisis due to both expectation of lower firm cash flows and a higher discount rate (investor risk aversion).

Cautions regarding findings include:

- The analysis is retrospective, not predictive. An elevated investment discount rate could persist, slowing recovery to pre-pandemic market highs.

- As noted in the paper, concurrent (1) eruption of a crude oil price war on March 7, (2) ongoing U.S. presidential election primaries and (3) developments in the U.S.-China trade war somewhat confound isolation of COVID-19 effects on stock returns.