How can investors account for inflation expectations in estimating attractiveness of equities? In their March 2020 article entitled “The Equity Risk Premium: A Novel Perspective on the Past Fifty Years”, James White and Victor Haghani offer a perspective on stock market long-term (10-year) attractiveness based on Equity Risk Premium (ERP) calculated as the difference between:

- Cyclically adjusted earnings yield as the real expected long-term stock market return. This measure is the inverse of cyclically adjusted price-to-earnings ratio (CAPE, or P/E10); and,

- The yield on 10-year U.S. Treasury Inflation Protected Securities (TIPS) as the long-term risk-free return.

Using monthly values of P/E10 since 1970, modeled yield of 10-year TIPS until their initial issue in 1999 and actual yield of 10-year TIPS as issued thereafter, all through March 18, 2020, they find that:

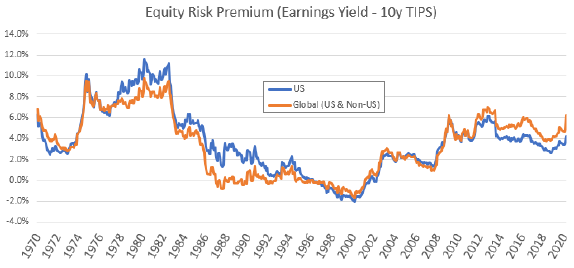

- As calculated above, ERP (see the chart below) is:

- Relatively high during 1975-1982.

- Relatively low during 1986-2008, bottoming in 2000.

- Moderately attractive since 2009.

- Current long-term return expectations for equities are relatively attractive, especially for global equities (in the top 20% of ERP values since 1970), consistent with above average allocation to stocks.

The following chart, taken from the article, tracks 10-year TIPS-based ERP since 1970. Its current value is in a relatively attractive range.

In summary, U.S. and global ERPs are relatively attractive for long-term investors when calculated based on long-term TIPS.

Cautions regarding findings include:

- The article does not include tests of: the usefulness of TIPS-based ERP as a stock market return predictor; or, any portfolio allocation strategies based on this variable.

- There is modeling risk in estimating 10-year TIPS yield before availability of actual securities.

- As noted in the article, the ERP estimation approach is long-term. It does not address short-term market fluctuations.

See also “Best Equity Risk Premium”.