Is retail trading a reliable driver of U.S. stock momentum? In his November 2019 paper entitled “Retail Trading and Momentum Profitability”, Douglas Chung investigates interactions across stocks between current proportion of retail trading and future momentum returns. Specifically, for each month and for each of two recent stock samples, he:

- Sorts stocks into fifths (quintiles) by current proportion of retail trading.

- Within each proportion-of-retail-trading quintile:

- Sorts stocks into sub-quintiles by return from 12 months ago to one month ago.

- Calculates average next-month returns for an equal-weighted momentum portfolio that is long (short) the sub-quintile of stocks with the highest (lowest) past returns. He also considers other portfolio weighting schemes.

- Measures alphas of these returns based on various widely accepted single-factor and multi-factor models of stock returns.

He next tests whether proportion of retail trading relates to a gambling motive (lottery trading) by constructing a stock lottery index from inverse of stock price, idiosyncratic volatility, idiosyncratic skewness and recent maximum daily return. In other words, he examines whether the lottery index value for a stock is a proxy for its proportion of retail trading. Using daily data for all NYSE retail orders during March 2004 through December 2014, for small NYSE trades of U.S. common stocks (a proxy for retail trading) during January 1993 through July 2000 and for lottery index inputs during 1940 through 2016, he finds that:

- During March 2004 to December 2014, excluding observations from the financial crisis (December 2007 to June 2009), next-month long-short momentum portfolio performance increases systematically from low to high quintiles of explicit proportion of retail trading. Average next-month momentum portfolio return for the equal-weighted quintile of stocks with the highest (lowest) proportions of retail trading is 1.51% (0.09%).

- Average next-month long-short momentum portfolio returns within extreme quintiles of proportions of retail trading exhibit significant alphas for different portfolio weighting schemes and different factor models of stock returns.

- However, the momentum crash of April 2009 through December 2009 wipes out cumulative momentum profits from March 2004 through March 2009.

- The earlier January 1993 through July 2000 sample using small trades as a proxy for retail trading generally confirms findings, with an even stronger systematic relationship between quintile of retail trading and next-month momentum portfolio performance.

- Recent samples indicate that stocks with large proportions of retail trading exhibit high lottery index values. In other words, lottery index value for a stock is a good proxy for its proportion of retail trading. Specifically:

- During 1940 through 2016, next-month long-short momentum portfolio performance increases systematically from low to high quintiles of stock lottery index value.

- Further analysis shows that lottery-like stocks exhibit strong comovements that amplify momentum portfolio performance.

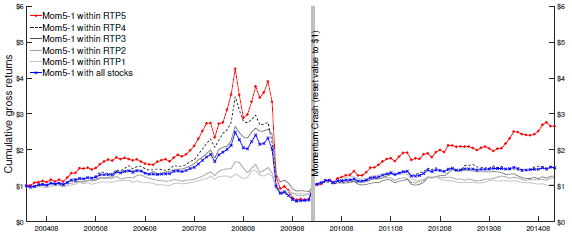

The following chart, taken from the paper, compares cumulative gross returns of equal-weighted long-short momentum portfolios (Mom5-1) for each quintile of proportion of retail trading (RTP1 to RTP5) during March 2004 through December 2014, with a reset of returns at the end of December 2009. Notable points are:

- Excluding the April 2009 through December 2009 momentum crash, Mom5-1 portfolio returns increase systematically from RTP1 through RTP5 (increasing proportion of retail trading), with those of RTP1 and RTP2 unprofitable.

- The momentum crash of April 2009 through December 2009 wipes out all preceding cumulative gains (maximum drawdown -86% for RTP5).

- Except for RTP5, the systematic relationship between Mom5-1 performance and proportion of retail trading is less pronounced after 2009.

In summary, evidence indicates a positive relationship between proportion of retail trading in stocks and future performance of a momentum portfolio holding the stocks, but a momentum crash may cancel the relationship.

Cautions regarding findings include:

- Data are stale, with explicit tests of proportion of retail trading ending 2014.

- Reported returns are gross, not net. Accounting for monthly reformation frictions and shorting costs/constraints would reduce returns for all portfolios. Moreover:

- Momentum portfolios typically generate high turnover.

- Stocks with highest proportions of retail trading may be the most costly to trade and are likely the most costly/difficult to short (few shares to borrow).

- Explicit retail trading data may be costly and complicated to process.

- As illustrated, accounting for proportion of retail trading does not mitigate, and may worsen, effects of momentum crashes. Incorporating crash returns may cancel findings.

- Tested strategies are beyond the reach of most investors, who would bear fees for delegating to a fund manager.