What are long run returns for commodity futures? In their September 2019 paper entitled “The Commodity Futures Risk Premium: 1871-2018”, Geetesh Bhardwaj, Rajkumar Janardanan and Geert Rouwenhorst estimate the historical risk premium of commodity futures from a long and broad sample free of survivorship bias covering 230 contract series traded since 1871 mostly in the U.S. and the UK. They calculate the premium as average excess return for rolling front-month contracts in three ways: (1) simple equal weighting of all monthly observations; (2) equal-weighted separately calculated premiums for each contract series; and, (3) average excess return for an equal‐weighted index series. They explore the link between survival of a contract series and its risk premium. They also estimate returns to basis or momentum factor strategies that are each month long (short) the equal-weighted half of available commodities with the higher (lower) futures basis or prior-year spot return. Using monthly prices for 230 commodity futures traded on 28 exchanges during 1871 through 2018, they find that:

- The historical annualized gross risk premium of commodity futures over the full sample period is:

- 5.32%, with annualized volatility 28.9%, based on equal weighting of all monthly observations.

- 2.33% based on the average of premiums for separate contract series (overweighting of poor returns for short-lived series).

- 5.20% based on the average return for an equal‐weighted index.

- Annualized gross premiums across sectors fall within a 2% range, except the relatively young energy sector.

- Subperiod premiums vary considerably across commodities and over time with the business cycle, inflation and sector‐specific shocks (scarcities). In general, premiums rise during economic expansions (on average, 14% higher than during contractions) and times of high unexpected inflation.

- 58% of contract series have a positive lifetime gross premiums, with median geometric average 1.5%.

- Contract series survival relates positively to series gross premium, with short‐lived series having a negative average premium.

- Over the full sample, contract series are more likely to be in contango (58%) than backwardation (42%), with the latter percentage falling over time. On average, series in backwardation strongly outperform those in contango (11.2% versus 1.2%), with this spread consistent across sectors except precious metals and for two subsamples with break point 1960.

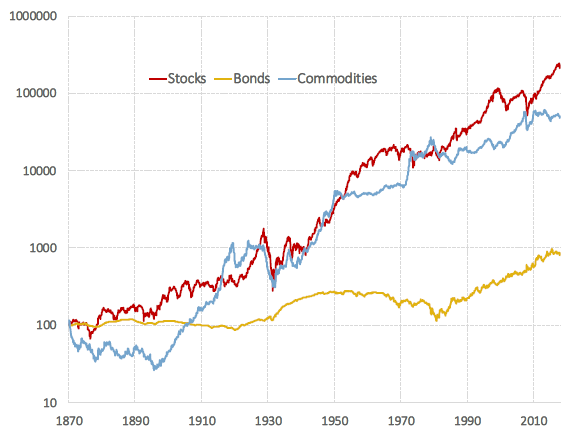

- The cumulative commodity risk premium is more like that of stocks than bonds in terms of magnitude and volatility (see the first chart below). Commodities have deep and long drawdowns, with the most dramatic occurring before 1900.

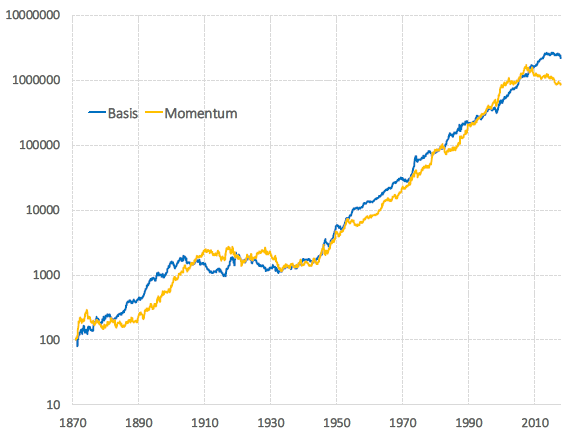

- Both basis (carry) and momentum portfolios beat an equal‐weighted index over the long run but still have deep and long drawdowns, with the longest persisting through World War I, the Great Depression and World War II (see the second chart below).

The following chart, taken from the paper, compares compares cumulative gross excess returns to stocks (Shiller’s Composite Index), bonds (dovetailed from Ibbotson/Morningstar, Bloomberg/Barclays and Siegel) and commodities futures over the full sample period based on indexes. Results indicate that commodities are more like stocks than bonds.

The next chart, also from the paper, shows gross cumulative excess returns to commodity futures basis and momentum factors over the full sample period. Performances are largely similar and stronger than that for the commodity futures index in the preceding chart.

In summary, evidence from a long sample indicates that commodity futures as an asset class offer a premium similar to that of equities.

Cautions regarding findings include:

- Reported returns are gross, not net. Accounting for costs of maintaining a tracking fund for a portfolio/index of commodities would reduce returns. Costs of maintaining tracking funds may vary across classes and over time. For example, the commodity futures index requires monthly rolling of many contract series.

- Economies and markets change over time, making it difficult to assess the relative importance of older versus newer data. Distant past availability of such indexes may have altered contemporaneous market behaviors.

- See “Bond Returns Over the Very Long Run” for an alternative view of bond returns.

See also “(Some) Commodities over the Long Run” and “Commodity Futures Strategies Over the Very Long Run”.