Can investors identify stocks that incorporate news slowly enough to allow exploitation? In their August 2019 paper entitled “Tomorrow’s Fish and Chip Paper? Slowly Incorporated News and the Cross-Section of Stock Returns”, Ran Tao, Chris Brooks and Adrian Bell classify stocks incorporating news quickly (QI) or slowly (SI) into prices and investigate implications for associated future returns. Specifically, they each month:

- Assign a sentiment score to each current-month news article about each stock based on words in the article.

- Double-sort stocks by thirds based first on current-month abnormal (adjusted for size, industry value and industry momentum) returns and then on news sentiment scores, yielding nine groups.

- Classify stocks that are: (a) high return/low sentiment (HRLS) or low return/high sentiment (LRHS) as SI; and, (b) high return/high sentiment (HRHS) or low return/low sentiment (LRLS) as QI.

- Measure average next-month returns of equally-weighted SI and QI portfolios that are, respectively: (a) long LRHS stocks and short HRLS stocks; and, (b) long HRHS stocks and short LRLS stocks.

- Measure average next-month return of an equally weighted portfolio that is long the SI portfolio and short the QI portfolio (Slow-Minus-Quick, SMQ).

They then examine whether limited investor attention or differences in news complexity and informativeness better explain results. Using firm-level news data, firm characteristics and associated stock returns for a broad sample of U.S. common stocks during 1979 through 2016, they find that:

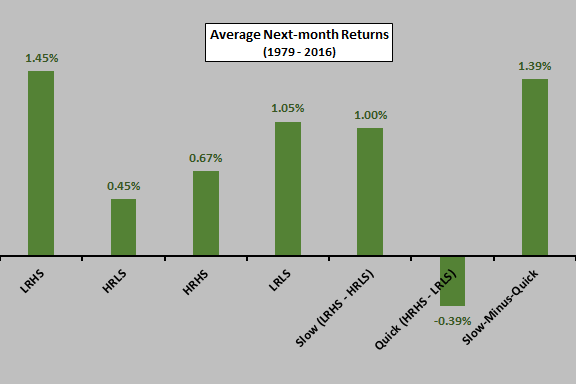

- Regarding effectiveness in predicting next-month return (see the chart below):

- When prior return and sentiment do not match (LRHS and HRLS), next-month return dramatically catches up or down to sentiment, with long-only LRHS generating average monthly gross return 1.45%.

- When prior return and sentiment match (HRHS and LRLS), next-month return moderately reverts.

- The SI hedge portfolio generates average monthly gross return 1.01%.

- The SMQ double hedge portfolio generates average monthly gross return 1.39%.

- Results are largely consistent for 1979-1987, 1988-1997, 1998-2007 and 2008-2016 subperiods.

- Factor model alphas for the SI portfolio are comparable in magnitude to average gross return, even when including a short-term reversal factor.

- Findings are robust to an alternative measure of news incorporation and an alternative sorting method.

- Based on four different investor attention proxies, performance of slow stocks is likely an investor inattention effect, not a result of news informativeness/complexity.

The following chart, constructed from data in the paper, summarizes average next-month gross returns for various monthly reformed, equal-weighted portfolios as defined above. As noted above:

- Next-month return catches up or down to sentiment when prior return and sentiment do not match (LRHS and HRLS).

- Next-month return when return and sentiment match (HRHS and LRLS).

- The long-only LRHS catch-up portfolio, the SI hedge portfolio and the SMQ double hedge portfolio may be attractive.

Costs/constraints involved in portfolio maintenance may reduce returns differently.

In summary, evidence indicates that investors may be able to exploit monthly mismatches between firm news sentiment and contemporaneous stock performance.

Cautions regarding findings include:

- Reported returns and alphas are gross, not net. Costs of sentiment analysis software/data, expert use of the software, monthly portfolio reformation frictions and shorting would reduce these returns. Shorting of some stocks may be impossible or very costly. Moreover:

- Equal weighting exacerbates cost concerns because small stocks typically have wider bid-asks spreads and lower capacities than larger stocks.

- The authors do not address portfolio turnover. The most complicated SMQ portfolio is likely the most costly to maintain.

- Average monthly return alone is insufficient for strategy evaluation. The paper does not address portfolio volatilities and drawdowns.

- The methodology described is beyond the reach of most investors, who would bear fees for delegating to a fund manager.