Is there a common optimal set of ranking (lookback) interval, holding interval, weighting scheme and skip-month rule for long-short stock momentum strategies across European country markets? In her May 2019 paper entitled “Are Momentum Strategies Profitable? Recent Evidence from European Markets”, Anastasia Slabchenko identifies optimal parameter sets from 576 long-short stock momentum strategy variations in each of France, Germany, Greece, Italy, Netherlands, Portugal, Spain, Sweden and UK. Variations derive from:

- Past return ranking (lookback) intervals of 1 to 12 months.

- Holding intervals of 1 to 12 months.

- Value weighted (VW) or equal-weighted (EW) momentum portfolios.

- Skip-month or no skip-month between ranking and holding intervals.

She defines the optimal variation as that generating the highest average gross monthly return. Using end-of-month closing prices for stock samples from each country, excluding financial stocks and stocks priced less than one euro, during December 1989 through January 2018, she finds that:

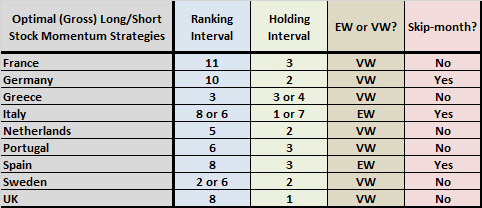

- Optimal momentum strategy parameter sets differ from country to country (see the chart below).

- Average gross monthly returns by country for optimal parameter sets range from 0.75% (Greece) to 1.69% (Sweden).

The following table, constructed from data in the paper, summarizes optimal long-short stock momentum strategy parameter sets by country based on highest average gross monthly return. Optimal ranking intervals vary considerably. Optimal holding intervals are mostly short. Optimal weighting is mostly VW. No skip-month is mostly preferable.

In summary, evidence from European country markets indicates that optimal parameter sets for long-short stock momentum strategies, based on average gross monthly return, vary by market.

Cautions regarding findings include:

- Reported momentum portfolio performance data are gross, not net. Costs of portfolio reformation and shorting would reduce all returns, and shorting may not always be feasible as specified. Moreover:

- Shorter ranking and holding intervals have higher turnover and trading frictions than longer ones, such that net findings may differ from gross findings.

- EW momentum portfolios hold larger positions in small stocks than VW portfolios. Since small stocks are typically less liquid and have higher trading frictions than large stocks, net findings may differ from gross findings.

- Highest average gross monthly return may not translate to highest gross cumulative return or highest Sharpe ratio over the sample period.

- Testing so many strategy variations on the same samples introduces extreme data snooping bias, such that optimal performances substantially overstate expectations.

- There is no fundamental reason to exclude financial stocks from momentum studies. Including financial stocks may affect findings.

For comparison, see “Optimal Intrinsic Momentum and SMA Intervals Across Asset Classes”.