Do all kinds of assets and long-short equity factor premiums exhibit exploitable time series (intrinsic or absolute momentum)? In their September 2018 paper entitled “Trends Everywhere”, Abhilash Babu, Ari Levine, Yao Hua Ooi, Lasse Pedersen and Erik Stamelos test intrinsic momentum on 58 traditional (studied in prior research) assets, 82 alternative (futures, forwards, and swaps not previously studied) assets and 16 long-short equity factors. They include only reasonably liquid (investable) assets and strategies. For equity factors, they each month: (1) classify over 4,000 U.S. common stocks as big or small according to NYSE median market capitalization; (2) within each size group, reform for each factor a value-weighted hedge portfolio that is long (short) the 30% of stocks with the highest (lowest) expected returns; and, (3) for each factor, average big and small hedge portfolio returns. They focus on a 12-month lookback interval for calculating momentum, taking a long (short) position in an asset/factor with positive (negative) return over this interval. For comparability of assets, they scale each position to an estimated 40% annualized volatility based on exponentially-weighted squared past daily returns. They assess diversification potentials by looking at pairwise correlations between momentum series, and between portfolios of momentum series and benchmark indexes (S&P 500 Index, MSCI World Index, Barclays Aggregate Bond Index and S&P GSCI Index). Using daily excess returns for the selected assets, factors and benchmarks as available during January 1985 through December 2017, they find that:

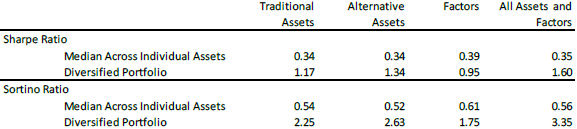

- For a 12-month lookback interval, gross annualized Sharpe ratio of an equal-weighted portfolio of intrinsic momentum series is:

- 1.17 for the 58 traditional assets.

- 1.34 for the 82 alternative assets.

- 0.95 for 16 long-short equity factors.

- 1.60 for all assets and factors considered together.

- For a 12-month lookback interval:

- Average pairwise correlations among intrinsic momentum series is 0.07, 0.06 and 0.04 within traditional assets, alternative assets and equity factors, respectively. In other words, component series are mutually diversifying.

- Correlations between equal-weighted portfolios of intrinsic momentum series and benchmark indexes range from -0.12 to 0.25, indicating that momentum portfolios substantially diversify asset classes.

- Statistics from time series regressions largely confirm portfolio-level findings.

- Gross outperformance compared to long-only diversified portfolios is generally robust for lookback intervals of 1, 3, 6, 9 and 12 months.

The following table, excerpted from the paper, summarizes gross annualized median Sharpe ratios and Sortino ratios of assets within each of traditional assets, alternative assets and equity factor, and overall. It also summarizes these metrics for diversified equal-weighted momentum portfolios by group and overall. Large differences between median and diversified portfolio results suggest that attractiveness of momentum strategies derives largely from a diversified portfolio approach.

In summary, evidence based on risk-adjusted performance indicates that intrinsic momentum is ubiquitous across asset classes and equity factors, on a gross basis.

Investors should be able to exploit underlying trends similarly using moving average indicators.

Cautions regarding findings include:

- Trading frictions associated with monthly portfolio reformation may be material and may vary considerably across assets and factors, thereby affecting findings. The authors assert: “While a study of transaction costs is beyond the scope of our analysis, we note that trading costs are likely higher for alternative assets and factors than for traditional assets. To ensure implementability, we primarily focus on 12-month time series momentum, which has the lowest turnover among any of the lookback horizons we consider. Indeed, the strong gross performance and low turnover of 12-month time series momentum demonstrate that the strategy is implementable even across alternative assets and factors.”

- Capacities of some assets and factors may be limited, such that large positions may materially affect trading frictions.

- The methodology (40% target volatility with no penalty for leverage), implies perhaps considerable leverage for some assets funded at the risk-free rate. This implication is unrealistic for some investors.

- There may be material costs associated with collection and processing of data for diversified momentum portfolios.

- Diversified momentum portfolio construction and maintenance is beyond the reach of many investors, who would bear fees for delegating portfolio construction and maintenance to a fund manager.