How should investors assess whether the market is fairly valuing cryptocurrencies such as Bitcoin? In his March 2019 paper entitled “Bitcoin Spreads Like a Virus”, Timothy Peterson offers a way to value Bitcoin based on Metcalf’s Law (network economics) and a Gompertz function (often used to describe biological activity). The former model estimates fair price based on number of active users, and the latter model estimates the growth rate of active users. Using findings from prior research plus daily Bitcoin price and active account data from coinmetrics.io and blockchain.info during July 2010 through February 2019, he finds that:

- The value of any currency depends primarily on its acceptance and use. The fair price of Bitcoin therefore varies with the number of active Bitcoin accounts.

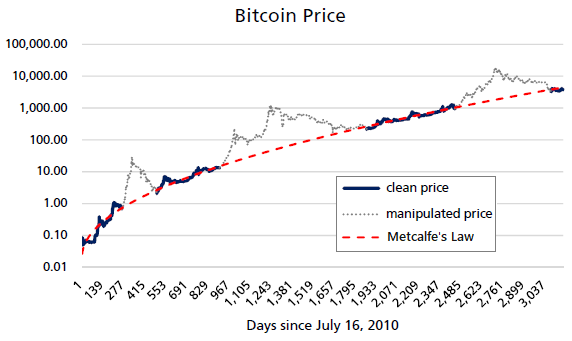

- Calibrating Metcalfe’s Law to the number of Bitcoin active accounts accurately estimates the fair price of Bitcoin over time, except during intervals of blatant manipulation (see the first chart below).

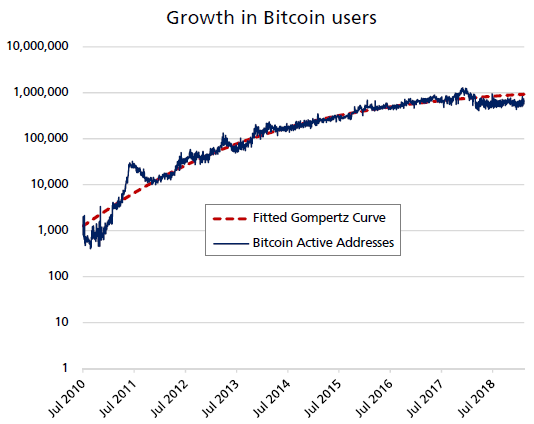

- Calibrating a Gompertz function to the number of active Bitcoin accounts accurately describes growth in number of accounts over time (see the second chart below).

The following chart, extracted from the paper, models Bitcoin price history in days from the start of the sample period according to Metcalfe’s Law based on the known number of active accounts. The fit ignores three local peaks in price strongly suspected to come from price manipulation.

The next chart, also from the paper, models the number of active Bitcoin accounts using a Gompertz function over the full sample period. Investors could use such a model to estimate the future number of accounts and then apply Metcalfe’s Law as in the preceding chart to estimate the future fair price of Bitcoin.

In summary, modeling suggests that investors can estimate a fair price for Bitcoin by combining the value of its network (Metcalfe’s Law) with “biological” growth in its active accounts (Gompertz function).

Cautions regarding findings include:

- As noted, analyses ignore parts of the Bitcoin price series deemed driven by manipulation.

- The above curves are fitted in-sample. An investor operating in real time would not know all the information used to calibrate associated models. The paper offers no analyses of the usefulness of the models in predicting Bitcoin price.