Do returns for equity factors (long stocks with high expected returns and short stocks with low expected returns based on some firm/stock trading characteristic) broadly and reliably exhibit momentum? In other words, do factors with strong (weak) returns in recent months have strong (weak) returns next month? In the February 2019 revision of their paper entitled “Factor Momentum Everywhere”, Tarun Gupta and Bryan Kelly test return momentum among 65 widely studied long-short equity factors for the U.S. and 62 factors globally that have underlying data available since the mid-1960s, including: valuation ratios (such as earnings-to-price and book-to-market); size, investment and profitability metrics (such as market capitalization, sales growth and return on equity); idiosyncratic risk metrics (such as betting against beta, stock volatility and skewness); and, liquidity metrics (such as Amihud illiquidity, share volume and bid-ask spread). For each factor, they each month:

- Exclude as outliers the top and bottom 1% of stocks with the most extreme factor characteristic values.

- Split residual stocks into big and small size segments based on median NYSE market capitalization for U.S. stocks and 80th percentile of market capitalizations for international stocks.

- Within size segments, sort stocks into low/medium/high characteristic bins based on 30/40/30 percentile splits and form value-weighted sub-portfolios that are long (short) high (low) bins.

- Form an overall factor portfolio with long side 0.5 * (Large High + Small High) and short side 0.5 * (Large Low + Small Low).

They consider both time series factor momentum (TSFM, intrinsic or absolute momentum) and cross-sectional factor momentum (CSFM, relative momentum). As benchmarks, they consider the equal-weighted average return for all factors and a conventional stock momentum factor based on returns from 12 months to one month ago. Using monthly U.S. and global data required to construct the factor portfolios and their returns from 1965 through 2017, they find that:

- For U.S. stocks:

- Three of 65 factors have negative average gross returns over the full sample period, and 25 are statistically insignificant. Those with strongest and most reliable gross performances include betting against beta, stock momentum, industry momentum and valuation ratios.

- Factor portfolios are largely distinct. Over half of factor portfolio pairs have monthly return correlations between -0.25 to 0.25.

- Average 1-month autocorrelation across all factors is 0.11, positive for 59 of 65 factors and significantly positive for 49, suggesting broad intrinsic (absolute or time series) momentum.

- A TSFM strategy that scales exposure to each factor proportionally to its past 1-month return outperforms unscaled exposures for 61 of 65 individual factors on a gross basis, and is statistically significant for 47.

- An equal-weighted combination of the 65 individual TSFM strategies with 1-month lookback interval generates gross annual return about 12% and gross annual Sharpe ratio 0.84, higher than that for any TSFM but lower than 1.07 for the benchmark equal-weighted 65-factor portfolio. While the 1-month lookback interval is optimal, intervals up to five years generate gross annual Sharpe ratios in the range 0.60-0.70.

- An equal-weighted CSFM strategy that buys (sells) factors with 1-month past returns higher (lower) than the median of all 65 actors has annual gross Sharpe ratio nearly 0.80, exceeding 0.56 for the conventional stock momentum factor.

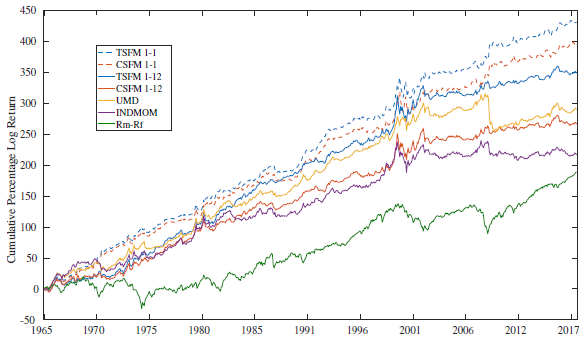

- The high correlation between combined TSFM and CSFM return series indicates a close relationship, with the former more fundamental than the latter (see the chart below).

- Factor momentum significantly boosts performance of investment strategies employing conventional stock momentum, industry momentum and value factors.

- For a 1-month and 12-month lookback intervals, factor momentum turnovers are slightly lower than those for conventional stock short-term reversal and momentum, respectively. However, turnovers are substantially greater than those for size, value, profitability and investment factors. Assuming trading frictions of 0.10%, net annual Sharpe ratio for combined TSFM with a 1-month (12-month) lookback interval is about 25% (10%) lower than gross annual Sharpe ratio.

- TSFM and CSFM performance data for international equity markets have magnitudes similar to those for the U.S. market.

The following chart, taken from the paper, compares cumulative gross return for six momentum strategies as applied to U.S. stocks over the full sample period:

- TSFM 1-1: combined TSFM strategy with 1-month lookback interval and monthly portfolio reformation.

- CSFM 1-1: CSFM strategy with 1-month lookback interval and monthly portfolio reformation.

- TSFM 1-12: combined TSFM strategy with 12-month lookback interval and monthly portfolio reformation.

- CSFM 1-12: CSFM strategy with 12-month lookback interval and monthly portfolio reformation.

- UMD: conventional stock momentum strategy.

- INDMOM: conventional industry momentum strategy.

It also shows U.S. stock market return minus the risk-free rate (Rm-Rf, excess market return). Notable points are:

- Combined TSFM outperforms CSFM.

- A 1-month lookback beats a 12-month lookback for both types of factor momentum.

- Three (four) of four factor momentum strategies outperform conventional stock (industry) momentum.

- Factor momentum strategies experience turbulence during the 2000-2002 bear market but do not crash during the 2008-2009 bear market.

In summary, evidence indicates that diversified equity factor momentum, whether intrinsic or relative, generates attractive gross performance over the past half century.

Cautions regarding findings include:

- The paper is vague on sample sources and start-end dates.

- Excluding outliers could screen out data errors or could screen out relevant extreme events.

- As noted, most performance data are gross, not net. The assumed 0.10% level of trading frictions, accounting for bid-ask spread, impact of trading and broker fees, is likely much too low for much of the sample period (see “Trading Frictions Over the Long Run”). Shorting may not be free or even feasible for all stocks to be shorted, depending on availability of shares to borrow.

- Creating and maintaining diversified factor momentum portfolios is beyond the reach of most investors, who would bear fees for delegating to a fund manager.

- Testing multiple strategies on the same sample introduces data snooping bias, both at factor and factor momentum portfolio levels, such that the best performances overstate expectations.

- As noted, Sharpe ratios for factor momentum strategies are lower than that for the simpler benchmark equal-weighted portfolio of all factors.

See also: