Personal residences represent the largest asset class allocation for many U.S. investors. What return do they generate, how do their returns relate to stock market returns and how do they vary across Metropolitan Statistical Areas (MSA)? In their January 2019 paper entitled “The Cross-Section of Expected Housing Returns”, Esther Eiling, Erasmo Giambona, Ricardo Lopez Aliouchkin and Patrick Tuijp examine how U.S. residential real estate returns vary across MSAs. They also examine relationships between MSA residential real estate returns and both U.S. stock market returns and overall U.S. residential real estate returns. Using monthly Zillow Home Value Index levels for 571 MSAs, zip code population data from the U.S. Census Bureau and U.S. stock market returns during April 1996 through December 2016, they find that:

- Annualized gross excess return (relative to 1-month U.S. Treasury bill yield) over the sample period is:

- 1.1% for U.S. residential real estate overall, with volatility 5.4%.

- 0.86% on average for residential real estate across MSAs, with volatility 9.6%.

- 8.0% for the U.S. stock market, with volatility 18.8%.

- Among the 178 MSAs with at least 15 zip codes:

- Average MSA residential real estate returns have close to zero exposure to stock market returns, thereby offering diversification of stock holdings.

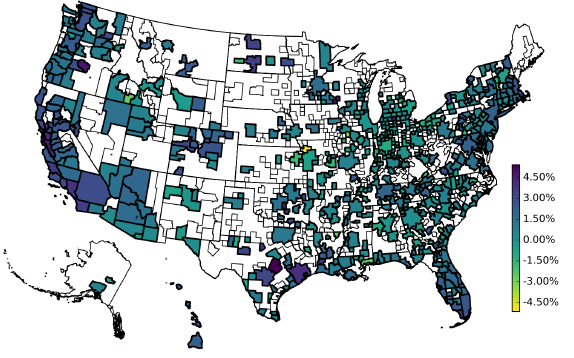

- Average MSA residential real estate return beta relative to the overall U.S. residential real estate market is close to one, but varies considerably across MSAs (see the chart below).

The following chart, taken from the paper, depicts dispersion of annualized gross excess returns for 571 U.S. MSAs. Highest excess returns (purple) are mostly in California, with a few among very populous east coast MSAs. Very few MSAs have negative excess returns, and in general these MSAs are less populous.

In summary, evidence indicates that returns on U.S. residential real estate are low over recent decades, with gains concentrated in a few regions. Residential real estate returns are essentially uncorrelated with U.S. stock market returns.

Caution regarding findings include:

- Reported returns are gross, not net. Since real estate transaction costs are high, achieving a net gain requires a very long holding period.

- Reported returns do not account for costs of owning a residence (equipment, maintenance, mortgage interest, insurance and taxes), which lower gross returns.

- Reported returns do not account for the alternative cost of renting, which effectively boosts return on ownership.