Should investors pursue initial coin offerings (ICO), special-purpose crypto-tokens? In their May 2018 paper entitled “Digital Tulips? Returns to Investors in Initial Coin Offerings”, Hugo Benedetti and Leonard Kostovetsky study the market for crypto-tokens, focusing on: initial pricing; returns from buying at ICO and selling at date of listing on an exchange; and, returns from buying at listing date and holding for various fixed intervals. ICOs typically originate with an offeror’s prospectus detailing a goal, plan, team and offering schedule. Interested parties then register for the offering, with execution typically in stages over several months, some restricted to preferred users, angel investors, venture capitalists and/or accredited investors. The authors also employ Twitter accounts of ICO offerors to test the relationship between Twitter activity and price and to measure post-ICO attrition rate of offerors. Using data for 2,390 ICOs completed by May 2018, including offeror Twitter histories as of May 8, 2018, they find that:

- 48% of the 2390 ICOs report capital raised. Others may be failures-to-report, failures-to-achieve minimum capital, failures-to-execute or scams. Among those reporting, average (median) capital raised is $11.5 million ($3.8 million).

- ICOs mostly occur in countries with above-average World Bank Rule of Law rankings and high standards of living, both of which relate positively to ICO success.

- Token markets are fairly liquid, with $3 million in average ICO daily volume during the 30 days after listing.

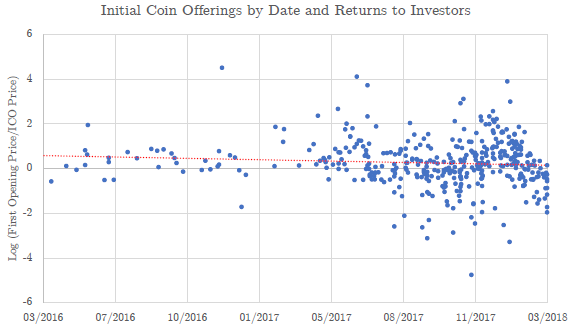

- Average gross return from ICO to first-day listing is 179% over a 16-day average holding period (see the scatter plot below). Even assuming -100% returns for ICOs that fail to list tokens within 60 days after ICO completion and adjusting for asset class (Bitcoin) return, average ICO-to-listing return is 82%.

- After listing, tokens continue to appreciate. Adjusting for overall crypto-asset appreciation by subtracting Bitcoin return, by subtracting the value-weighted average token return or by subtracting the return to a market capitalization-matched token that has traded for at least one year, average gross abnormal returns for newly listed ICOs range from:

- 14% to 16% the first day.

- 41% to 67% the first 30 days.

- 150% to 430% the first 180 days.

- ICO returns are positive and significant whether the overall crypto-asset class is performing well or poorly.

- Offerors of listed ICOs have average (median) Twitter history 9.4 months (4 months). There is a slight positive relationship between length of history and ICO success.

The following scatter plot, taken from the paper, plots ICO-to-listing returns for those of the 2,390 ICOs that achieve listing versus time over the available sample period. The red dotted line is linear best-fit. Results indicate that:

- Most ICOs appreciate dramatically at listing (but many lose value).

- The trend in appreciation is downward over time.

Results imply that an investor would have to hold many ICOs to achieve high confidence in a positive average return.

In summary, available evidence indicates that ICOs on average appreciate strongly from ICO to listing and for at least six months after listing, but with wide variability in returns.

Cautions regarding findings include:

- As noted, returns are gross, not net. Trading frictions may materially reduce reported returns.

- As noted, an investor would have to hold many ICOs for confidence in generating a positive average return, requiring considerable capital.

- Moreover, without knowing how many ICOs will become available over time, an investor would have to reserve considerable cash for purchase of future ICOs, thereby considerably dampening portfolio-level performance.

- Average return is not sufficient as a portfolio performance metric. There appears to be substantial risk of large drawdowns (risk of ruin for unlucky entry points).

- While the authors assert that the crypto-token market is liquid, the market may not support many large investors.