Do currency exchange factor strategies usefully diversify a set of conventional asset classes? In their May 2018 paper entitled “Currency Management with Style”, Harald Lohre and Martin Kolrep investigate the systematic harvesting of currency exchange carry, value and momentum strategies, specified as follows and applied to the G10 currencies:

- Carry – buy (sell) the three equally weighted currency forwards with the highest (lowest) short-term interest rates, reformed monthly.

- Momentum – buy (sell) the three equally weighted currency forwards with the greatest (least) appreciation over the past three months, reformed monthly.

- Value (long-term reversion) – buy (sell) the three equally weighted currency forwards with the lowest (highest) change in their real exchange rates, based on purchasing power parity, over the past 60 months, reformed monthly.

They examine in-sample (full-sample) mean-variance relationships for these strategies to assess their value as diversifiers of five conventional asset classes (U.S. stocks, commodities, U.S. Treasury bonds, U.S. corporate investment-grade bonds and U.S. corporate high-yield bonds). They also look at potential out-of-sample benefits of these strategies based on information available at the time of each monthly rebalancing as additions to a risk parity portfolio of the five conventional assets from the perspective. For this out-of-sample test, they consider both minimum variance (tail risk hedging) and mean-variance optimization (return seeking) for aggregating the three currency strategies. Using monthly data for the selected assets from the end of January 1999 through December 2016, they find that:

- Based on in-sample analysis:

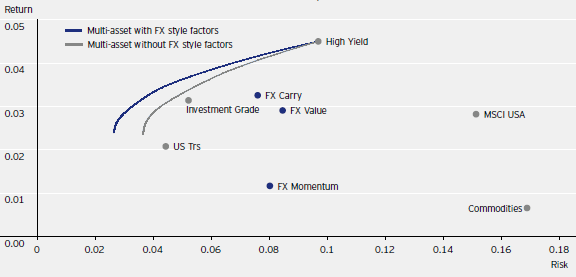

- Adding currency exchange strategies to the conventional assets increases diversification, thereby shifting the mean-variance efficient frontier up and to the left (see the chart below).

- From the perspective of euro investors who fully hedge dollar/euro exposure:

- The momentum strategy is important only for extremely risk-averse investors.

- The carry strategy replaces some of the U.S. high-yield bond allocation.

- The value strategy is broadly beneficial, claiming about 20% of overall holdings for many investors.

- Based on out-of-sample analysis:

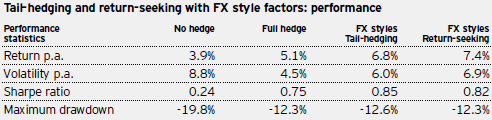

- Adding currency strategies substantially outperforms conventional investment allocations with no dollar/euro hedge and modestly outperforms conventional allocations with a full dollar/euro hedge (see the table below).

- The minimum variance approach for currency strategy allocations picks mostly value and momentum.

- The mean-variance optimization approach for currency strategy allocations picks mostly value and carry.

The following chart, taken from the paper, plots average annualized gross excess return versus annualized variance of returns over the full sample period for the currency exchange (FX) carry, momentum and value strategies and for U.S. stocks (MSCI USA), U.S. Treasury bonds (US Trs), U.S. investment-grade and high-yield corporate bonds and commodities. It also shows two efficient frontiers base on assets sets with and without currency strategies. Conventional asset class returns are from the perspective of a European investor fully dollar/euro-hedged. The efficient frontier with currency strategies generally offers higher average gross excess return per unit of variance, indicating incremental diversification benefits.

The following table, also from the paper, compares gross annual excess returns, annual volatilities, gross annual Sharpe ratios and maximum drawdowns for:

- A conventional multi-class, mean-variance optimized portfolio from the perspective of a European investor with and without a dollar/euro-hedge.

- An augmentation of the conventional portfolio with currency exchange strategies (FX styles) aggregated via minimum variance (tail-hedging).

- An alternative augmentation of the conventional portfolio with FX styles aggregated via mean-variance optimization (return-seeking).

Results show that adding currency exchange strategies boosts return with modest volatility penalty compared to full currency hedging.

In summary, evidence indicates that investors may be able to improve the efficiency of conventional asset portfolio dollar/euro hedging by adding carry, momentum and value currency exchange strategy exposures.

Results suggest that the currency exchange carry and value factor portfolios may also be otherwise attractive.

Cautions regarding findings include:

- As noted, performance data are gross, not net. Accounting for portfolio reformation and rebalancing frictions would reduce returns. Such return reductions may affect findings.

- Methods are beyond the reach of most investors, who would bear fees for delegating analysis and portfolio maintenance to a fund manager.

- As noted, results are from the perspective of European investors. The paper does not address potential benefits of currency exchange strategies directly for U.S. investors.