Do changes in firm financial reporting practices signal bad news to come? In the February 2018 update of their paper entitled “Lazy Prices”, Lauren Cohen, Christopher Malloy and Quoc Nguyen investigate relationships between changes in firm financial reporting practices (SEC 10-K, 10-K405, 10-KSB and 10-Q filings) and future firm/stock performance. They focus on quarter-to-quarter changes in content bases on four distinct textual similarity metrics. Each month, they rank all firms into fifths (quintiles) for each of the four metrics. They then compute equally weighted or value-weighted returns for these quintiles over future months (such that there are overlapping portfolios for each quintile and each metric), with stock weights within quintile portfolios rebalanced monthly for equal weighting. They measure the effect of changes in financial reporting practices as monthly return for a hedge portfolio that is long (short) the quintile with the smallest (greatest) past changes. Using the specified quarterly and annual SEC filings by U.S. corporations from the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) database and corresponding monthly stock returns during 1995 through 2014, they find that:

- Firms that change financial reports significantly underperform those that do not.

- Across the four textual similarity metrics, extreme quintile hedge portfolios generate average gross monthly returns in the range 0.18%-0.53% for equal weighting and 0.34%-0.55% for value weighting. The effect does not concentrate in small stocks.

- Returns continue to accrue up to 18 months after portfolio formation and do not reverse, implying a fundamental effect.

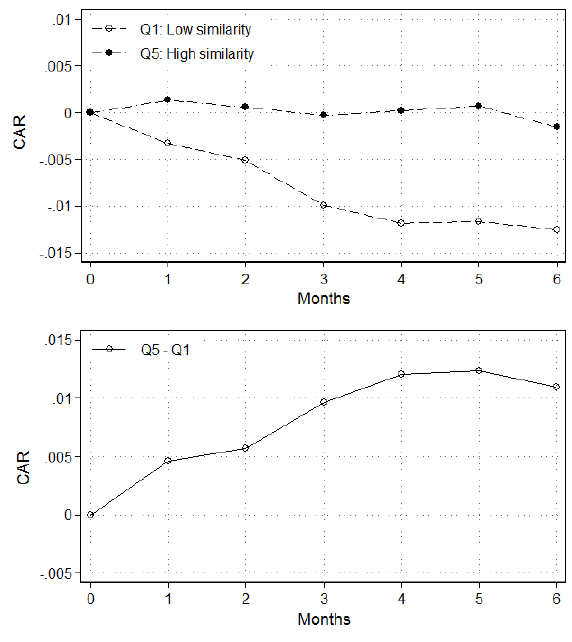

- Most of the returns for most similarity metrics come from portfolio short sides. Moreover, any positive alpha from the long side quickly reverts to zero, while negative alpha from the short side persists and never reverses (see the chart below).

- 3-factor (market, size, book-to-market) and 5-factor (adding momentum and liquidity) gross monthly alphas for these portfolios are similar to raw returns, so widely used risk factors do not explain the effect. The effect does not concentrate in hard-to-short stocks.

- Natural language processing indicates that 86% (14%) of changes have negative (positive) sentiment. A hedge portfolio for the 14% with positive sentiment have significantly positive average gross monthly return, suggesting a potential refinement.

- Reporting changes concentrate in the Management’s Discussion and Analysis section of quarterly reports. Reporting changes referring to the CEO and/or the CFO and those addressing litigation and risk factors are especially informative about future returns. For example, hedge portfolios focusing on changes in risk factors have gross monthly 5-factor alphas up to 1.88%.

- Reporting changes also predict future firm earnings, profitability, news and bankruptcies.

- Findings are robust to controlling for conventional risk factors, industry, earnings surprises and other news releases. They are also consistent over time.

- Reporting changes have no announcement effect on returns, suggesting that investors initially fail to recognize their import. There are some cases when investors appear to download multiple financial reports spanning this and last year. In these cases, the reporting changes effect is weak.

The first of the two following charts, taken from the paper, plots average cumulative value-weighted gross 5-factor alpha over the six months after portfolio formation for:

- Low similarity – the quintile of stocks with the greatest changes in financial reports over the past year.

- High similarity – the quintile of stocks with the least changes in financial reports over the past year.

Results show that most of the hedge portfolio alpha and all of its permanent value, shown in the second chart, come from the short (low similarity) side.

In summary, evidence indicates that changes in firm SEC financial reporting practices are generally bad news and may be exploitable by shorting associated stocks.

Cautions regarding findings include:

- As noted, reported returns are gross, not net. Accounting for costs of periodic portfolio reformation and monthly portfolio rebalancing (for equal weighting) would reduce these returns. Costs of shorting, which is critical to exploitation, would also reduce returns.

- The textual analysis employed is beyond the reach of most investors, who would bear fees for delegating to a fund manager. Such fund managers would have to invest in textual analysis tools and expertise.

- Testing multiple textual similarity metrics introduces data snooping bias, such that the best-performing metric overstates expectations.

- While extended from the prior version, data still end with 2014.