Are published stock return anomalies exploitable worldwide? In their January 2018 paper entitled “Does it Pay to Follow Anomalies Research? International Evidence”, Ondrej Tobek and Martin Hronec investigate out-of-sample and post-publication performances of 153 cross-sectional stock return anomalies documented in the academic literature, mostly in the top three finance and top three accounting journals. Of the 153 anomalies, 93 involve firm fundamentals, 11 involve firm earnings estimates and 49 involve market frictions. They calculate returns for each anomaly via a hedge portfolio that is long (short) the value-weighted fifth, or quintile, of stocks with the highest (lowest) expected returns for that anomaly. To ensure capacity, they focus on the universe of stocks in the top 90% of NYSE capitalizations. They first examine out-of-sample (after the sample used for discovery but before publication) and post-publication performances of anomalies among U.S. stocks for evidence of performance decay. They then look at anomaly performance outside the U.S. They further test whether strategies that work most widely should be of greatest interest to investors. Finally, they consider a multi-anomaly strategy that each year invests equally in all anomalies that are significant in the U.S. through June, starting in July 1990 for developed country markets and July 2000 for emerging country markets. Using required firm/stock data since July 1963 for the U.S., since January 1987 for Europe, Japan and developed Asia-Pacific and since January 2000 for China and emerging Asia-Pacific, all through December 2016, they find that:

- For anomalies in U.S. stocks since July 1963, gross returns:

- Fall dramatically out-of-sample, indicating that anomaly discoveries are due to data snooping bias.

- Exhibit some further decay post-publication, perhaps due to exploitation by fund managers that intensifies after 2003 in an environment of increasing data availability and declining trading frictions.

- Findings are similar for anomalies in non-U.S. equity markets.

- It appears that anomalies that work most widely attract the most attention and thereby suffer the greatest out-of-sample decay. For example, anomalies that are significant in both the U.S. and Europe have on average 47% lower out-of-sample gross returns compared to those significant only in the U.S.

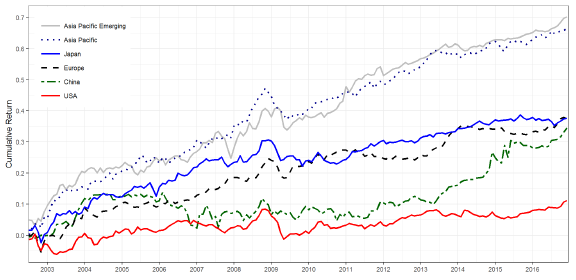

- The annually reformed multi-anomaly strategy specified above does not generate significantly positive gross returns in the U.S. since July 1990. Gross profitability of this strategy is higher outside the U.S. (see the chart below) due to higher trading frictions, such that net returns are insignificant.

- Using hedge portfolios formed from extreme tenths (deciles) of anomaly variable sorts rather than extreme quintiles confirms findings with generally higher gross profitabilities.

The following chart, taken from the paper, compares cumulative gross returns of the multi-anomaly strategy that each July invests equally in all published anomalies that are significant in the U.S. at the 5% level using data available through June, starting in 2002. The strategy is unimpressive in the U.S., yielding a gross return of just 11% over the full period. The strategy exhibits much higher gross profitability in other regions, particularly Asia-Pacific. However, higher trading frictions outside the U.S. explain some of the performance differences.

In summary, evidence indicates that data snooping plays a considerable role in discovery of stock return anomalies worldwide.

Cautions regarding findings include:

- As noted in the paper, many findings are gross, not net. Accounting for anomaly portfolio trading frictions and multi-anomaly strategy reformation frictions materially reduces anomaly returns. Moreover, anomaly portfolios assume shorting of half the portfolio at no cost, which may not be feasible.

- It is possible that findings of academic research become known among fund managers before publication, such that the immediate weakening of anomalies out-of-sample is due partly to data snooping and partly to market adaptation.

See also the closely related “Effects of In-sample Bias and Market Adaptation on Stock Anomalies”.