Do stock return momentum and reversal strategies work better when focused on certain intraday intervals rather than close-to-close, according to whether trades are primarily exploiting information or supplying liquidity? In his April 2017 paper entitled “Reversal, Momentum and Intraday Returns”, Haoyu Xu examines intraday versions of momentum and reversal anomalies, with focus on the first two hours and the last two hours of the normal U.S. trading day. He hypothesizes that information-driven trades drive momentum profitability early in the day, and liquidity-driven trades drive reversal profitability late in the day. His anomaly measures are:

- Momentum – (1) sort stocks into tenths (deciles) by cumulative close-to-close or first 2-hour returns over a 6-month ranking interval; (1) skip one month or six months (echo momentum); and, (3) form a portfolio that is long (short) the equally weighted decile with the highest (lowest) past returns; and, (4) hold for one month or six months.

- Reversal – (1) sort stocks into deciles by cumulative close-to-close, first 2-hour or last 2-hour returns over the past month; (2) form a portfolio that is long (short) the equally weighted decile with the lowest (highest) returns; and, (3) hold for one month.

His principal performance metrics are average gross raw monthly return, gross monthly 3-factor alpha (adjusting for market, size and book-to-market), gross monthly 4-factor alpha (adding momentum) and gross monthly 5-factor alpha (adding short-term reversal ). Using daily and intraday prices for a broad sample of U.S. common stocks with prices at least $5 and in the top 90% of NYSE capitalizations during January 1993 through December 2014, he finds that:

- Monthly cumulative first (last) 2-hour return relates positively (negatively) to next-month return. For close-to-close returns, the two effects largely cancel.

- Regarding momentum hedge portfolios (6-month ranking interval, a skip month and 1-month holding interval):

- Conventional momentum generates average gross monthly raw return 1.13%, gross monthly 3-factor alpha 1.39% and gross monthly 4-factor alpha 0.36%. Gross monthly Sharpe ratio is 0.15.

- First 2-hour (9:30-11:30) momentum generates average gross monthly raw return 1.00%, gross monthly 3-factor alpha 1.24% and gross monthly 4-factor alpha 0.82%. Gross monthly Sharpe ratio is 0.19.

- Conventional (first 2-hour) momentum suffers a drawdown of 73% (60%) during the 2008-2009 financial crisis.

- Conventional momentum returns become negative for holding periods more than 12 months. First 2-hour momentum has no return reversal within 48 months.

- First 2-hour momentum has some size dependency, with gross monthly 3-factor alpha 1.58% and 0.76% for the equally weighted smallest and largest thirds of stocks, respectively. Value weighting is therefore substantially less profitable than equal weighting.

- Conventional (first 2-hour) momentum has gross monthly 3-factor alpha 2.31% (1.39%) during 1993-2003 and 0.41% (0.81%) during 2004-2014. While both weaken, first 2-hour momentum weakens less.

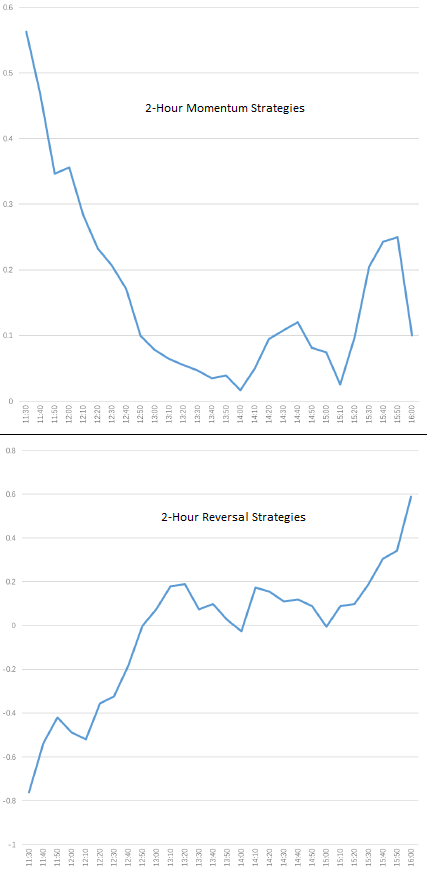

- Gross monthly 4-factor alphas of a series of 28 overlapping 2-hour momentum hedge portfolios with past return measurements ending each 10 minutes of the trading day from 11:30 to 16:00 confirm that the momentum anomaly happens early in the day (see the first chart below).

- Regarding reversal hedge portfolios (1-month ranking interval and 1-month holding interval):

- Conventional reversal generates monthly gross raw return 0.13% per month, gross monthly 3-factor alpha -0.16% and gross monthly 4-factor alpha 0.03%.

- First 2-hour (9:30-11:30) reversal generates average gross monthly raw return -0.58%, gross monthly 3-factor alpha -0.78% and gross monthly 4-factor alpha -0.74%.

- Last 2-hour (14:00-16:00) reversal generates average gross monthly raw return 0.61%, gross monthly 3-factor alpha 0.53% and gross monthly 4-factor alpha 0.59%.

- Last 2-hour reversal generates a gross monthly 5-factor alpha (controlling for conventional reversal) of 0.50%, indicating that it is incremental to conventional reversal.

- Similar last 1-hour and last 10-minute reversal hedge portfolios generate gross monthly 5-factor alphas of 0.62% and 0.85%, respectively.

- Last 2-hour reversal has some size dependency, with gross monthly 3-factor alpha 0.65% and 0.41% for the equally weighted smallest and largest thirds of stocks, respectively. Value weighting is therefore again substantially less profitable than equal weighting.

- Last 2-hour reversal has gross monthly 3-factor alpha 0.96% during 1993-2003 and 0.35% during 2004-2014, indicating substantial weakening.

- Gross monthly 5-factor alphas of a series of 28 overlapping 2-hour reversal hedge portfolios with return measurements ending each 10 minutes of the trading day from 11:30 to 16:00 confirm that the reversal anomaly happens late in the day (see the second chart below).

The following charts, taken from the paper summarizes alphas of 28 overlapping 2-hour momentum hedge portfolios (upper chart) and 28 2-hour reversal hedge portfolios (lower chart) constructed based on ending times every 10 minutes intraday as specified above over the full sample period.

- Momentum hedge portfolios use a 6-month ranking interval for cumulative returns during intraday windows of two hours, a 1-month skip interval and a 6-month holding interval. Only the first four intervals (ending 11:30-12:00) have significant alphas. In other words, momentum is a morning effect.

- Reversal hedge portfolios use a 1-month ranking interval for cumulative returns during intraday windows of two hours and a 1-month holding interval. The first interval of the day has the lowest gross monthly 5-factor alpha, and all seven windows before 12:40 have significantly negative alphas. The 18 windows ending 12:40 through 15:30 have insignificant alphas. Only the last three windows ending 15:40 through 16:00 have significantly positive alphas. In other words, reversal is an afternoon effect.

In summary, evidence indicates that trades in the morning are mostly information driven and trades in the afternoon are mostly liquidity driven, leading to concentration of the momentum anomaly in the morning and concentration of the reversal anomaly in the afternoon.

Cautions regarding findings include:

- All return/alpha calculations are gross, not net. Trading frictions for monthly portfolio reformation and shorting costs would reduce reduce performance. Shorting may not be feasible as specified due to lack of shares to borrow. Concentration of effects among smaller stocks amplifies this concern.

- Hedge portfolio maintenance is data/calculation-intensive and beyond the reach of most investors, who would bear fees for delegating to an investment/fund manager.

- The approach expands strategy parameters beyond ranking and holding intervals (with potentially inherited snooping bias) to 28 intraday windows (with new latitude for snooping bias). The best (worst) intraday intervals overstate (understate) expected performance. The regularity of findings mitigates this concern.

- As noted, even the intraday-refined anomalies weaken substantially from the first half of the sample period to the second half.

See also: