Does “sell-in-May” interact with the U.S. election cycle? In the April 2017 update of their paper entitled “Buy Equities in Winter and Sell in May in Pre-Election Years: Market Premiums and Political Uncertainty in the Presidential Cycle”, Kam Fong Chan and Terry Marsh examine interactions between seasonal (May-October versus April-November) and U.S. election cycle effects on U.S. Stock market returns. They focus on variations in the equity premium, defined as market return minus risk-free rate. Using monthly returns for U.S. equities since January 1927 and for U.S. Treasury bonds since January 1942, and contemporaneous 1-month U.S. Treasury bill yields as the risk-free rate, all through December 2015 (89 years and 22 presidential election cycles), they find that:

- For the U.S. stock market during 1927-2015 (see the chart below):

- For the full sample, the annualized average equity premium is 5.8%, with standard deviation 18.7%.

- The annualized average equity premium is 10.0% (1.7%) during November-April (May-October).

- The annualized average equity premium is 13.5% (3.2%) in pre-presidential election (other) years.

- The annualized average equity premium is 10.6% (0.5%) under Democratic (Republican) presidents.

- The annualized average equity premium is 23.0% (4.1%) during November-April (May-October) of pre-presidential election years. This combined premium averages 21.3% (24.9%) under Democratic (Republican) presidents. Notable exceptions to the average finding are 1939, 1943 and 2003.

- During 1942-2015, the annualized average U.S. Treasury bond term premium is 1.4%, with standard deviation 6.8%. The term premium is highest during May-October of midterm election years.

- A strategy allocating 100% to U.S. Treasury bonds during May-October of midterm election years, 150% to the U.S. equity market during November-April of pre-presidential election years and 100% to the U.S. equity market in all other half-years generates gross compound annual growth rate 11.8%.

- The combined November-April/pre-presidential election year effect is generally robust: across subperiods; for a sample extended backward to 1871; to exclusion of January returns; to exclusion of outliers; and, for several non-U.S. equity markets. The most likely driver of the effect is economic policy uncertainty.

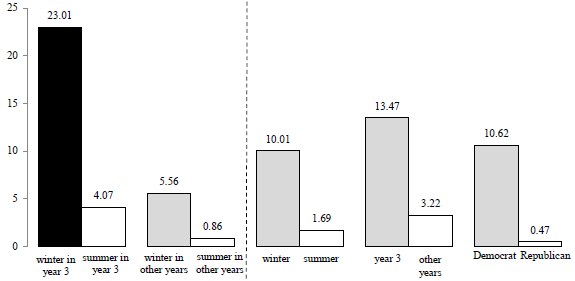

The following chart, taken from the paper, compares annualized average U.S. equity premiums in percent for various subsamples during 1927 through 2015, including:

- November-April (winter) versus May-October (summer) during the third year (year 3) of the U.S. presidential term cycle.

- Winter versus summer of other years of the U.S. presidential term cycle.

- Winter versus summer of all years.

- U.S. presidential term cycle year 3 versus other term cycle years.

- Years under democrat versus republican presidents.

In summary, evidence indicates that November-April of pre-presidential election years is on average an extremely attractive time to invest in equity markets, regardless of party holding the presidency.

Cautions regarding findings include:

- Use of indexes ignores costs of creating and maintaining liquid funds, thereby overstating expected returns.

- Party-in-power analyses assume all power resides in the presidency. For another perspective including party holding majorities in the House and Senate, see “Party in Power and Stock Returns”.

- The featured investment strategy is in-sample, assuming foreknowledge of seasonal and presidential term cycle anomalies. Trading frictions for this strategy would reduce performance.

See also: