Do equity market volatility behaviors predict financial crises? In their October 2016 paper entitled “Learning from History: Volatility and Financial Crises”, Jon Danielsson, Marcela Valenzuela and Ilknur Zer investigate linkages among stock market volatility, risk-taking and financial market crises over the very long run. Their volatility measurement methodology is:

- Measure volatility annually as standard deviation of 12 monthly returns (July through June).

- Determine the volatility trend via an annually iterated Hodrick-Prescott filter applied to historical volatility data (focusing on smoothing factor 5000, but considering other values).

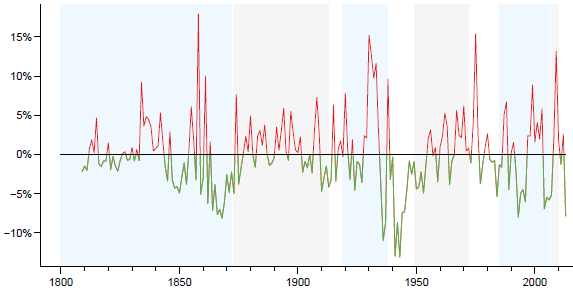

- Calculate relatively high and low volatility as deviations of volatility above and below trend, respectively (see the chart below).

Their stock market return sample covers 60 countries and spans 211 years, with an average 62 years per country (with U.S. and UK the longest subsamples). They discard a few extreme observations and adjust returns for inflation using local consumer prices indexes. Their crisis measurement is a binary indicator of whether one of 262 identified banking crises occurs in a given year and country. They focus on five-year regressions to assess volatility-crisis relationships, but consider other intervals. They consider Gross Domestic Product per capita, inflation, change in government debt and institutional quality (political freedom) as control variables. Using monthly data as specified and available during 1800 through 2010, they find that:

- Based on available subsamples, average annual stock market volatilities for developed and emerging countries are 16% and 23%, respectively.

- Regarding volatility-crisis linkages:

- Level of volatility per se does not predict crises.

- Volatility above trend increases likelihood of future crises in the near term, but the linkage is not significant after accounting for control variables.

- Prolonged periods of volatility below trend distinctly increases likelihood of future crises in the long term both in-sample and out-of sample, with strongest predictive power when volatility stays low for at least five years.

- The linkage between volatility above and below trend and crises is stronger later in the sample period (when stock markets are more important and less regulated).

- Results are consistent with the hypotheses that: (1) volatility below trend promotes gradual risk-taking (credit buildup); and, (2) accumulated risk induces volatility above trend at the onset of a crisis.

- Findings are robust to alternative model specifications, sample selections and definitions of volatility, crises and risk-taking.

- Stock market volatility metrics have no power to predict currency crises.

The following chart, taken from the paper, depicts times of volatility above trend (red) and below trend (green) for the U.S. stock market as specified above for the base trend smoothing factor. Shaded intervals represent: pre-gold standard (1800-1872), gold standard (1873-1913), interwar (1919-1938), Bretton Woods (1949-1972) and the disinflationary Great Moderation (1985-2006).

In summary, evidence indicates that long periods of below-trend stock market volatility tend to presage short periods of above-trend volatility accompanying financial market crises.

Cautions regarding findings include:

- Visual inspection of the above chart does not strikingly support statistical findings.

- The model is fairly complex, involving selection of multiple parameter values. The strongest findings thereby incorporate snooping bias and overstate predictive power.

- The study takes a regulatory perspective and does not address economic significance of findings via any asset allocation strategies.