Do short sellers who publicly attack their targets affect stock prices? How do they choose their targets? In his October 2016 paper entitled “Activist Short-Selling”, Wuyang Zhao studies short sellers who publish adverse research on and/or publicly disparage the stocks they short. To assess unique effects of the negative publicity on targeted stock prices, he compares performances of targeted stocks on negative publicity days with those of the same stocks, and of industry peers with the closest or highest contemporaneous levels of short interest or increases in short interest, on short interest release days (five separate benchmarks). To identify characteristics of firms that attract activist short sellers, he examines 12 indicators of stock overvaluation and nine measures of uncertainty about firm prospects. Based on initial tests, he constructs aggregate metrics for overvaluation (averaging seven of the overvaluation indicators) and uncertainty (averaging six of the uncertainty measures) for subsequent tests. Using stock prices and firm characteristics related to 6,197 cases of activist short selling reported in Seeking Alpha or Activist Shorts Research during mid-February 2006 through December 2015, he finds that:

- Activist short-selling increases rapidly over the sample period, with surges in 2011 and 2013. Targeted stocks are about equally split between NASDAQ and NYSE/AMEX.

- Mean (median) Fama-French three-factor alpha (adjusting for market, size and book-to-market factors) for targeted stocks on publicity day is -1.56% (-0.58%). The average mean (median) alpha across the five benchmarks on short interest release days is -0.09% (-0.10%).

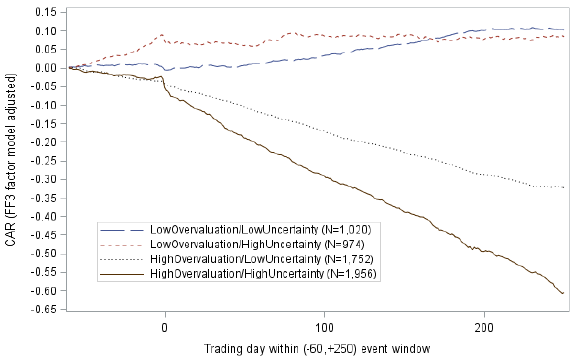

- Overvaluation indicators tend to drive long-term returns of targeted stocks, while uncertainty measures tend to drive short-term responses to negative publicity (see the chart below).

- Targeted stocks with aggregate overvaluation metric above the median generate average three-factor alpha -45% over the next year. Those with aggregate overvaluation metric below the sample mean have slightly positive alpha.

- Average market reactions are more negative when the case is:

- Reported in Activist Shorts Research rather than Seeking Alpha.

- Covered by other financial media.

- Initiated by well-known short-sellers.

- Based on multivariate regressions, activist short sellers focus on:

- Seven overvaluation indicators (“bubble” allegations): recent price run-up; high price-to-book value ratio relative to peers; high price-to-intrinsic value ratio; high asset growth; high non-operating assets; low recent earnings; and, high probability of accounting manipulation.

- Six uncertainty measures (“fraud” allegations): low accounting quality; absence of large block holders; few persistent institutional investors; high bid-ask spread; non-Big 4 auditor; and, weak internal controls.

- Firms with high uncertainty are more likely to accuse short sellers of manipulation or provide information refuting allegations.

- Aggregate overvaluation and uncertainty metrics do not predict short interest, change in short interest or analyst downgrades/sell recommendations.

The following chart, taken from the paper, compares average cumulative abnormal returns (CAR, meaning here cumulative three-factor alpha) from 60 trading days before through 250 trading days after activist short seller attacks for four groups of targeted stocks:

- Low aggregate overvaluation and low aggregate uncertainty.

- Low aggregate overvaluation and high aggregate uncertainty.

- High aggregate overvaluation and low aggregate uncertainty.

- High aggregate overvaluation and high aggregate uncertainty.

Low (high) means below (above) sample median values. Results indicate that overvaluation drives long-term return, while uncertainty drives immediate reaction to activist publicity.

In summary, evidence indicates that investors may be able to find good long-term short positions by focusing on stocks indicated as overvalued and targeted by activist short sellers identified in Activist Shorts Research.

Cautions regarding findings include:

- Reported alphas are gross, not net. Accounting for the costs of activist short seller identification, overvaluation assessment, trading and shorting would reduce alphas. The best shorting targets may difficult/costly to borrow for shorting.

- Mean and median statistics suggest that effects of activist short selling may be concentrated in a relatively few extreme cases.

- Overvaluation assessments may be beyond the reach of some investors, who would bear fees for delegating to an expert.

- Many investors may not be able to hold a diverse enough portfolio of shorting targets for a reliable outcome. Delegating portfolio diversification to a fund would involve fees.