Do measures of investor attention to specific firms/stocks indicate how the stocks react to earnings surprises? In their July 2016 paper entitled “Yahoo Finance Search and Earnings Announcements”, Alastair Lawrence, James Ryans, Estelle Sun and Nikolay Laptev investigate the interaction of investor attention and earnings surprises. They focus on abnormal Yahoo Finance search activity as the measure of attention. They define abnormal search activity on a certain day as the total number of searches that day minus average number of searches on the same day of the week during the prior 10 weeks, divided by average number of searches on the same day of the week during the prior 10 weeks. They examine the interaction of abnormal search activity and standardized unexpected earnings (earnings surprises). For comparison they also consider interaction of earnings surprises with three other commonly used measures of investor attention: abnormal trading volume, EDGAR search and Google Trends search. Using daily search and quarterly earnings announcement data during July 2014 through June 2015 (14,172 firm-earnings announcement observations) and associated daily stock returns during July 2014 through June 2016, they find that:

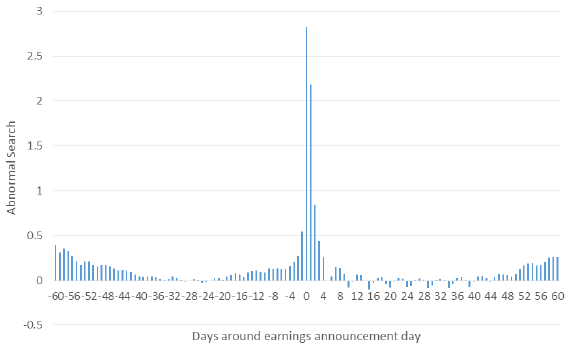

- On average across all stocks, abnormal Yahoo Finance search peaks on earnings announcement day at about 280%, remains very high the day after earnings announcement day at about 220% and then fades to normal levels over the next five days (see the chart below).

- Stocks in the highest (lowest) fifth, or quintile, of abnormal Yahoo Finance search have average earnings announcement day abnormal search about 680% (34%).

- Attention to specific stocks is somewhat persistent, with about a third of firm-quarters remaining within the same abnormal search quintile from quarter to quarter.

- Searched pages suggest that investors seek reactions from analysts/financial media to assess earnings announcements.

- Average cumulative market-adjusted return during earnings announcement day through the next trading day is:

- 3.2% (0.1%) for stocks in the highest quintile of earnings surprise and the highest (lowest) quintile of abnormal Yahoo finance search.

- -4.8% (-0.8%) for stocks in the lowest quintile of earnings surprise and the highest (lowest) quintile of abnormal Yahoo finance search.

- Average cumulative market-adjusted return during trading days 2 through 60 after earnings announcement day is:

- 0.5% (-5.4%) for stocks in the highest quintile of earnings surprise and the highest (lowest) quintile of abnormal Yahoo finance search.

- -2.5% (-6.9%) for stocks in the lowest quintile of earnings surprise and the highest (lowest) quintile of abnormal Yahoo finance search.

- Average cumulative market-adjusted return during trading days 61 through 250 after earnings announcement day is:

- -5.5% (-10.5%) for stocks in the highest quintile of earnings surprise and the highest (lowest) quintile of abnormal Yahoo finance search.

- -11.3% (-22.3%) for stocks in the lowest quintile of earnings surprise and the highest (lowest) quintile of abnormal Yahoo finance search.

- Finding are similar for sales surprises in lieu of earnings surprises, and for both 4th quarter-only and non-4th quarter earnings announcements.

- Abnormal EDGAR search and abnormal Google Trends search are less informative than abnormal Yahoo Finance search in explaining earnings responses and subsequent returns. Abnormal volume is competitive with abnormal Yahoo Finance search in explaining short-window reactions to earnings surprises and, in fact, explains about 35% of the variation in Yahoo Finance search.

The following chart, taken from the paper, shows the distribution of average abnormal Yahoo Finance search activity around earnings announcement day for firms/stocks in the available sample. Abnormal search peaks on earnings announcement day and the next day, thereafter reverting to normal over the following week. This extreme investor attention affects average price reactions to earnings surprises.

In summary, evidence indicates that retail investor attention as proxied by abnormal Yahoo Finance search substantially affects stock price reactions to earnings announcements, amplifying immediate reactions and differentiating subsequent longer-term drift.

Cautions regarding findings include:

- Yahoo Finance firm/stock search data is not publicly available and is therefore unexploitable by retail investors.

- Yahoo Finance firm/stock search data has unknown potential availability lag time and therefore unknown exploitability in immediate price reactions.

- Reported average returns are gross, not net. Accounting for trading frictions for entering and exiting trades to exploit tendencies would reduce these returns.

- As noted in the paper, the sample period is short, and findings may not be representative of other sample periods.

- As noted in the paper, the study is unable to conclude whether investor attention drives the earnings responses or whether it simply reflects some other measure of earnings announcement importance.