Subscribers have proposed that asset class momentum effects should accelerate (shorter optimal ranking interval) when markets are in turmoil (bear market/high volatility). “Asset Class Momentum Faster During Bear Markets?” addresses this hypothesis in a multi-class, relative momentum environment. Another approach is to evaluate the relationship between time series (intrinsic or absolute) momentum and volatility. Applied to the S&P 500 Index and the S&P 500 Implied Volatility Index (VIX), this alternative offers a longer sample period less dominated by the 2008-2009 equity market crash. Specifically, we examine monthly correlations between S&P 500 Index return over the past 1 to 12 months with next-month return to measure strength of time series momentum (positive correlations) or reversal (negative correlations). We compare correlations by ranked fifth (quintile) of VIX at the end of the past return measurement interval to determine (in-sample) optimal time series momentum measurement intervals for different ranges of VIX. We also test whether: (1) monthly change in VIX affects time series momentum for the S&P 500 Index; and, (2) VIX level affects time series momentum for another asset class (spot gold). Using monthly S&P 500 Index levels and spot gold prices since January 1989 and monthly VIX levels since inception in January 1990, all through April 2016, we find that:

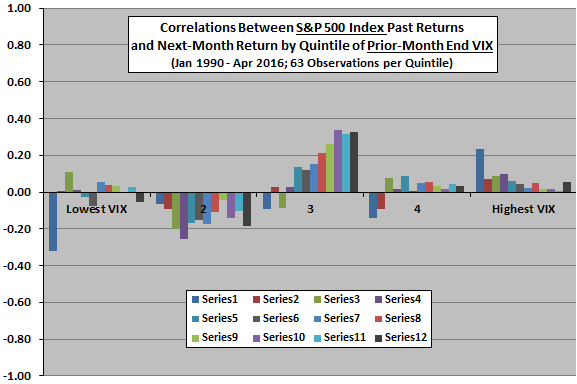

The following chart summarizes S&P 500 Index past return-future return correlations for past return measurement intervals ranging from 1 month (Series1) to 12 months (Series12) by quintile of VIX at the end of the past return measurement interval. As noted, there are 63 observations per quintile. Results suggest that S&P 500 Index time series momentum:

- Is very inconsistent across ranges of VIX.

- Within ranges of VIX, is mostly unsystematic across past return measurement intervals.

- Works best for the middle range of VIX and long past return measurement intervals.

- Generally works better for high VIX than low VIX.

- Does not work for 1-month past return except when VIX is very high.

For another perspective/conclusions, we look at a heat map and a best/worst list.

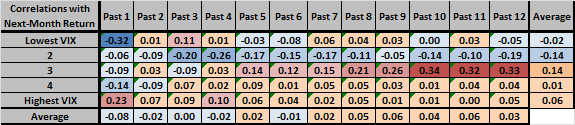

The following table is a heat map of S&P 500 Index past return-future return correlations, with orange/red (blue) shading indicating degree of times series momentum (reversal) by past return ranking interval and VIX range. Averages confirm that time series momentum tends to work best overall for longer ranking intervals and middle/higher levels of VIX.

Results are generally not systematic across past return measurement intervals or across ranges of VIX, undermining belief in any reliable relationship.

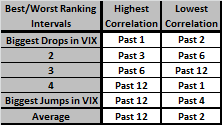

The next table distills best and worst past return measurement intervals (for S&P 500 Index time series momentum) by VIX quintile and on average.

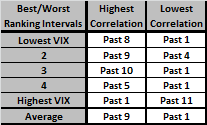

How does S&P 500 Index time series momentum interact with monthly change in VIX?

The next chart summarizes S&P 500 Index past return-future return correlations for past return measurement intervals ranging from 1 month (Series1) to 12 months (Series12) by quintile of change in VIX during the last month of the past return measurement interval. As noted, there are 63 observations per quintile. Results suggest that S&P 500 Index time series momentum:

- Works only for the biggest recent drops and (especially) jumps in VIX.

- Works best for biggest jumps in VIX and long past return measurement intervals.

- Works worst when VIX is stable and long past return measurement intervals.

As a distillation, we list the best and worst ranking intervals by quintile of change in VIX.

The following table distills best and worst past return measurement intervals (for S&P 500 Index time series momentum) by quintile of change in VIX and on average.

How does time series momentum for spot gold interact with VIX?

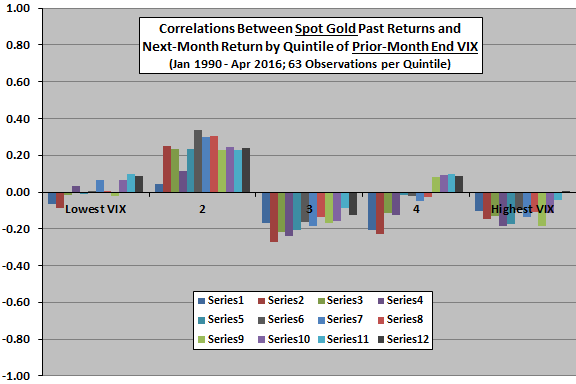

The final chart summarizes spot gold past return-future return correlations for past return measurement intervals ranging from 1 month (Series1) to 12 months (Series12) by quintile of VIX at the end of the past return measurement interval. As noted, there are 63 observations per quintile. Results suggest that spot gold time series momentum:

- Interacts with VIX very differently from the S&P 500 Index.

- Is very inconsistent across ranges of VIX.

- Within ranges of VIX, is mostly unsystematic across past return measurement intervals.

- Works best for below-average values of VIX and middle past return measurement intervals.

As a distillation, we list the best and worst ranking intervals by VIX quintile.

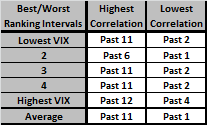

The final table distills best and worst past return measurement intervals (for spot gold time series momentum) by VIX quintile and on average.

In summary, evidence from analyses of available data offer little support for belief in a reliable relationship between past return measurement interval for equity and gold time series momentum and equity market implied volatility.

Cautions regarding findings include:

- Though the sample is more than 25 years long, it is still modest when parsed into monthly quintiles and in terms of number of low-high VIX regimes.

- Past return-future return correlations may not translate precisely to the economic value of time series momentum strategies.

- Interaction with VIX of single-asset class time series momentum and multi-asset class relative momentum may be very different.

- As noted, analyses are in-sample. An investor operating in real time during the sample period could not know the results. Available data is scant for out-of-sample testing.

- Analyses assume no delay between calculations of past returns and next-month returns. Inserting a delay could affect findings.