Is the VIX futures roll yield (roll return) exploitable via exchange-traded products (ETPs) designed to track direct, levered or inverse VIX futures indexes? In their March 2016 paper entitled “VIX Exchange Traded Products: Price Discovery, Hedging and Trading Strategy”, Christoffer Bordonado, Peter Molnar and Sven Samdal test abilities of the seven most traded such ETPs (VXX, XIV, TVIX, UVXY, SVXY, VIXY and VXZ) to hedge the S&P 500 Index. They also propose a trading strategy designed to capture VIX futures roll yield that pairs VXX with SPDR S&P 500 Trust ETF (SPY) as a hedge and XIV with ProShares Short S&P 500 ETF (SH) as a hedge. The strategy:

- Buys XIV+SH when nearest-month VIX futures cross above VIX by a specified relative threshold (+8%) and sells when they cross back below a threshold (+6%).

- Buys VXX+SPY when nearest-month VIX futures cross below VIX by a specified relative threshold (-8%) and sells when they cross back above a threshold (-6%).

They test SH/SPY hedges ranging from 0% to 100% of associated XIV/VXX positions, in increments of 10% (with no rebalancing while positions are open). They assume brokerage fee 0.20% and bid-ask spread 0.15% (based on historical average) to estimate trading frictions. Using simulated daily data for the ETPs before their respective inceptions (ranging from January 2009 to October 2011) and actual daily data thereafter during late June 2006 through late April 2014, they find that:

- VIX ETPs track their benchmark VIX futures indexes well, with very negative expected returns that make them unsuitable as buy-and-hold investments.

- The ETPs generally provide S&P 500 Index crash protection, but they perform poorly as continuous hedges because of their poor returns.

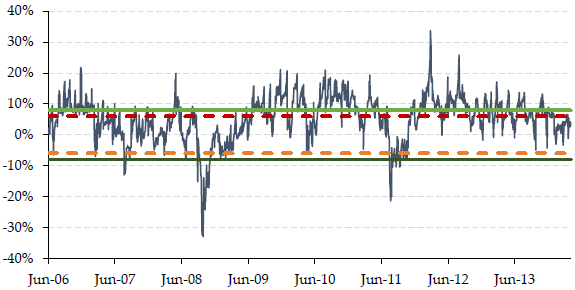

- The roll yield inherent in the ETPs is usually positive but varies considerably over time (see the chart below).

- For the trading strategy designed to exploit the changing roll yield, over the entire simulated/real data sample period (see the second chart below):

- The number of buy and sell signals is 106, with average position duration 18 trading days.

- The unhedged version (no SPY or SH holdings) is the most profitable, with net annualized return 69%, annual volatility 39%, maximum drawdown -24%, net annual Sharpe ratio 2.11 and Sortino ratio 3.17.

- Hedging with progressively larger and larger SHY or SH positions generally reduces volatility and maximum drawdown, but also reduces Sharpe and Sortino ratios.

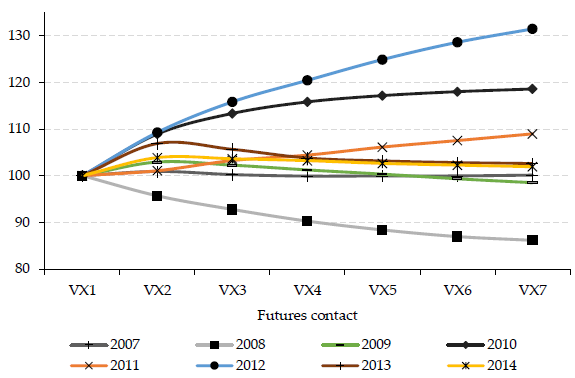

The following chart, taken from the paper, summarizes average VIX futures term structures relative to one-month normalized futures prices during each of years 2007 through 2014. The roll yield is usually positive (in contango, upward sloping term structure) but can be materially negative (in backwardation, downward sloping term structure) as in 2008.

The next chart, also from the paper, is a graph of the percentage difference between nearest VIX futures contract price and VIX level during late June 2006 through late April 2014. The proposed trading strategy:

- Buys simulated/actual XIV+SH when the graph cross above the solid light green line (+8%) and sells when the graph crosses below the dashed red line (+6%).

- Buys simulated/actual VXX+SPY when the graph crosses below the solid dark green line (-8%) and sells when the graph crosses above the dashed orange line (-6%).

The strategy usually trades XIV (VIX futures in substantial contango) and occasionally trades VXX (VIX futures in substantial backwardation).

In summary, evidence indicates that investors may be able to capture part of the VIX futures roll yield by timing positions in VXX and XIV.

Cautions regarding findings include:

- Use of simulated data prior to respective ETP inceptions ignores any effects of trading feedback to the market.

- Trading strategy results may be sensitive to the buy/sell threshold values and therefore subject to data snooping bias in their selection based on in-sample optimization. Threshold sensitivity testing and/or out-of-sample testing would verify or mitigate this concern.

See also “Identifying VXX/XIV Tendencies”, “Exploiting VIX Futures Roll Return with ETNs” and “Exploiting the Volatility Risk Premium with ETNs”.