How well do mutual funds and exchange-traded funds (ETF) designed to track hedge fund indexes work? In their October 2015 paper entitled “Synthetic Hedge Funds”, Mario Fischer, Matthias Hanauer and Robert Heigermoser examine the performance of synthetic hedge funds, defined as open-end mutual funds and ETFs that explicitly employ hedge fund indexes as their primary benchmarks. They assess replication success: (1) based on both return distribution shapes and risk-adjusted performance; and, (2) overall, for mutual funds and ETFs separately as groups, and by specific hedge fund strategy (when enough synthetic funds exist for a strategy). They group funds via value-weighted portfolios. Using monthly returns for 72 synthetic hedge funds (52 mutual funds and 20 ETFs) and associated Credit Suisse hedge fund index benchmarks during January 2009 through December 2013, they find that:

- Overall, synthetic hedge funds significantly underperform benchmark indexes. Specifically, synthetic hedge funds:

- Have a significantly negative alpha in a regression against hedge fund index returns.

- Have a higher number of substantially negative returns than the hedge fund indexes.

- Are more driven by equity market indexes than hedge fund indexes.

- Have much larger tracking errors relative to hedge fund indexes during crises than during stable/boom markets.

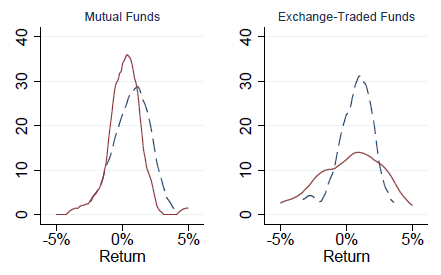

- Based on lower tracking error, better monthly return distribution match (see the charts below) and statistical insignificance of negative alpha, mutual funds are better than ETFs as synthetic hedge funds, perhaps because the mutual funds are more active than the ETFs.

- Regarding specific hedge fund strategy groups, synthetic hedge funds are:

- Largely successful in replicating long/short equity, market neutral and managed futures indexes.

- Unsuccessful in replicating multi-alternative and fund-of-funds indexes.

The following charts, taken from the paper, compare synthetic hedge fund monthly return distributions to targeted hedge fund index return distributions by fund type. The left (right) chart focuses on mutual fund (ETFs) with stated goals of tracking hedge fund indexes. Visually, the mutual fund group more accurately replicates hedge fund index performance than does the ETF group, with the latter having a large number of bad monthly returns. Both groups underperform the hedge fund indexes.

In summary, evidence from available data indicates that investors seeking liquid funds that replicate hedge funds should focus on mutual funds designed to track long/short equity, market neutral and managed futures hedge fund indexes.

Cautions regarding findings include:

- Since hedge fund return reporting is voluntary, hedge fund indexes may optimistically represent industry experience.

- The hedge fund index replication models used by mutual fund and ETF providers may involve parameter snooping, thereby overstating expected tracking accuracy.