Are high-yield government bonds good bets? In his January 2016 paper entitled “Finding Yield in A 2% World”, Mebane Faber applies a simple value metric to global government bonds. He specifies a value portfolio as the equally weighted third (Top 33%) of 30 government bonds with the highest nominal yields, reformed/rebalanced monthly. He considers two benchmarks: (1) an equally weighted portfolio of all 30 bonds (Equal Weight); and, (2) a GDP-weighted index of 10-year government bonds of 17 non-U.S. developed countries (Foreign 10-year). He also considers performance of U.S. government Treasury bills (T-bills), 10-year notes and 30-year bonds. Using monthly total returns for the specified bonds in U.S. dollars during 1950 through 2012, he finds that:

- Long-term gross performance increases systematically with nominal yield, with gross annual Sharpe ratios ranging from 0.13 for the bottom fourth of yields to 0.57 for the top fourth.

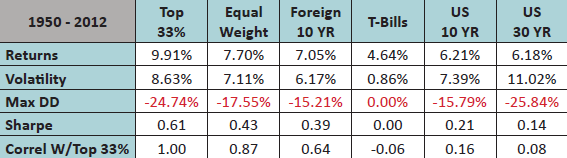

- On a gross basis over the entire sample period, the Top 33% portfolio (see the table below):

- Beats bond portfolio benchmarks by at least 2% per year.

- Does not have an extraordinarily high maximum drawdown.

- Is potentially diversifying, with low monthly return correlations with U.S. Treasury notes and bonds (-.06 to 0.16), and with the S&P 500 Index (0.28) and gold (0.31).

- The Top 33% portfolio beats the other bond portfolios in most decades.

- Current yield for the Top 33% portfolio is about 7%, compared to 3.6% for an equally weighted portfolio of bonds for all 30 countries.

The following table, excerpted from the paper, compares gross performance statistics for the Top 33% portfolio to those for various benchmarks. Results indicate that Top 33% gross performance is generally attractive and effectively diversifies U.S. Treasuries.

In summary, evidence indicates that apparently risky high-yield government bonds are potentially attractive yield-boosters and diversifiers of U.S. Treasury notes and bonds.

Cautions regarding findings include:

- Results do not account for trading frictions for monthly portfolio reformation/rebalancing. These frictions would reduce performance and may differ across the portfolios presented. In mitigation, the author reports that results are similar for annual reformation/rebalancing.

- Investors may not have efficient access to Top 33% bonds, and would bear management and administrative fees for access through a fund or funds that maintain a rolling portfolio of these bonds.

- Per the paper, short-term currency exchange rate variations “can have major impact on returns.” In other words, investors should view high-yield government bonds as a long-term allocation.

- As noted in the paper, the Top 33% portfolio involves some ostensibly unstable countries, but historical data indicate that volatility/drawdowns are not extreme.