Do stocks worldwide generate most of their total return while the market is open or closed? In their October 2015 paper entitled “Making Money While You Sleep? Anomalies in International Day and Night Returns”, Kevin Aretz and Sohnke Bartram decompose returns and factor premiums into day and night components. When aggregating returns across countries, they first average within countries and then across countries. They estimate factor premiums in each country by ranking stocks into fifths (quintiles) using the same sorting rules as Fama and French and then calculating differences in value-weighted or equal-weighted average returns between extreme quintiles. Using total returns and accounting variables needed to construct factor returns for 48,413 stocks from 35 countries during 1993 (limited by availability of opening prices) through 2011, they find that:

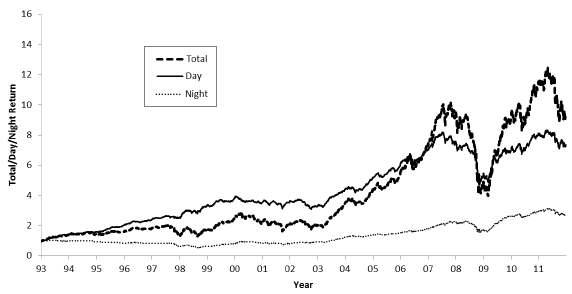

- The average aggregate annualized total return over the sample period is 12.3%, with annual standard deviation 13.8%.

- Most of this return comes during the day. The average aggregate annualized gross day (night) total return is 10.5% (5.4%), with annual standard deviation 8.2% (8.2%). However:

- There are large differences across countries, with about the same number of countries exhibiting significantly positive and significantly negative differences between day returns and night returns.

- The difference between day and night returns is significantly negative at the start of the week, but significantly positive at the end.

- Day returns are larger than night returns for 9 of 12 calendar months, most prominently for December.

- The dominance of day returns concentrates during 1993-1998. During 1999-2011, night returns are larger than day returns for 8 of 13 calendar years.

- Size, book-to-market, momentum, long-term reversal, accruals, net share issuance, asset growth and profitability factor returns tend to be positive during the day and negative or zero at night, whether factors are formed via equal or value weighting of extreme quintiles.

- The finding that momentum occurs overnight in the U.S. (corroborating “Momentum Happens at Night?”) is the exception rather than the rule. Momentum generally derives from day returns outside the U.S.

The following chart, taken from the paper, tracks cumulative total return, gross day return and gross night return averaged across all country markets. Day and night cumulative returns do not represent realistic strategies because they imply daily 200% turnover, but they might inform other active strategies.

In summary, evidence indicates that day returns are generally larger than night returns for stocks and equity factors worldwide (but the first third of the sample period appears to drive results).

Cautions regarding findings include:

- As noted, reported day and night returns are gross, not net. Direct exploitation requires daily portfolio formation and liquidation.

- As noted, inconsistencies across countries and over time (with data for 1993-1998 driving findings) undermine belief that day returns will reliably beat night returns in the future. Trading mechanisms have changed considerably over the sample period.

See also “Overnight Momentum-informed Overnight Trading”, “Buy at the Close and Sell at the Open?” and “The Lure of Trading at the Open?”.