Are frontier government bonds useful as incremental diversifiers of diversified portfolios? In their September 2015 paper entitled “Frontier and Emerging Government Bond Markets”, Vanja Piljak and Laurens Swinkels examine the diversification value of U.S. dollar-denominated frontier government bonds at aggregate, regional and country levels. They first look at return correlations and then consider mean-variance portfolio optimization with global equities, U.S. Treasury bonds, U.S. high-yield corporate bonds, emerging government bonds and frontier government bonds. Using weekly total returns in U.S. dollars for 29 frontier government bond markets in the J.P. Morgan Next Generation Markets Index and for other J.P. Morgan bond indexes and the MSCI All Country World Index during December 2001 through December 2013, they find that:

- Over the sample period, the total market value of frontier government bonds increases from $9.7 billion to $50.6 billion.

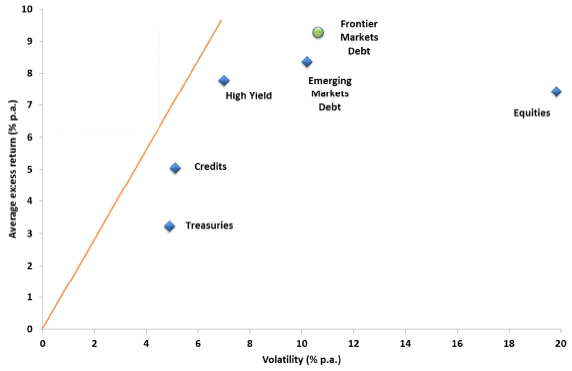

- Average yield at the end of the sample period is 7.85% (compared to 6.28% for emerging government bonds), ranging from 3.22% for Jordan (maturity 1.85 years) to 11.19% for Argentina (maturity 16.59 years). The volatility of frontier government bonds in aggregate is similar to that of emerging government bonds (see the chart below).

- In aggregate over the entire sample period, frontier government bonds have very low correlation with U.S. Treasuries (0.01, compared to 0.17 for emerging government bonds), but high correlations with U.S. corporate high-yield bonds (0.60) and emerging government bonds (0.73). Correlations are similar for frontier regions.

- However, these correlations vary considerably over short intervals and across frontier countries.

- Based on gross returns, the diversification benefit of frontier government bonds in aggregate, while positive, is not statistically significant for a portfolio already holds U.S. corporate high-yield bonds or emerging government bonds (see the chart below).

- Moreover, frontier government bonds are about twice as costly to trade as emerging government bonds, with overall median friction 1.24% (spiking to over 9% in 2008).

- Findings are generally robust, but weaker, for monthly data and for subperiods.

The following chart, taken from the paper, shows gross annual excess return (relative to the risk-free rate) versus volatility (standard deviation of excess returns) for various asset class indexes over the entire sample period. The orange line is the mean-variance efficient frontier for a portfolio of all classes. Results indicate that frontier government bonds are similar to emerging government bonds, with a little higher return and slightly higher volatility.

In summary, evidence offers little support for belief that frontier government bonds materially enhance an already diversified portfolio.

Cautions regarding findings include:

- As noted in the paper, the available history of frontier government bonds is relatively short for assessment of diversification properties.

- Specifically, the entire sample period is a bull market (falling interest rates) for many types of bonds. Findings may be substantially different during a bond bear market.

- Large investors may face capacity/impact of trading issues when managing positions in frontier government bonds, especially if trying to exploit country differences.

- Using indexes rather than tradable assets tends to overstate expected returns, because indexes do not include the costs of maintaining liquid funds.