Do small capitalization stocks exploitably lag broad market trends? In their October 2015 paper entitled “Slow Trading and Stock Return Predictability”, Matthijs Lof and Matti Suominen investigate whether overall stock market trends predict variation in the size effect and therefore the performance of small capitalization exchange-traded funds (ETF). For size effect testing, they each year at the end of June rank stocks into tenths (deciles) by market capitalization and calculate the size effect as the difference in value-weighted average returns between the smallest and largest deciles. Using daily returns, trading volumes and institutional buying and selling data for a broad sample of U.S. common stocks during 1964 through 2014 and for a selection of small capitalization ETFs as available through 2014, they find that:

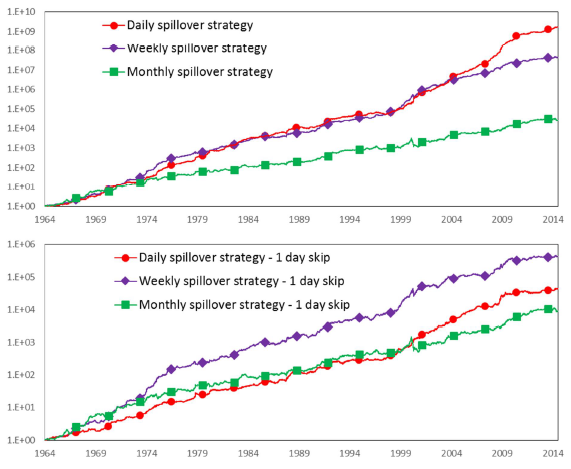

- Market returns predict the size effect at daily, weekly and monthly measurement frequencies (see the first two charts below).

- A strategy that is long the size effect when prior-interval market return is positive and short the size effect when prior-interval market return is negative generates gross annualized returns (Sharpe ratios) of 52% (2.86), 41% (2.12) and 21% (0.94) for daily, weekly and monthly market return measurement/portfolio reformation frequencies, respectively.

- Average gross monthly four-factor (market, size, book-to-market, momentum) alphas for the strategy are 0.48, 0.43 and 0.23, respectively.

- Average numbers of long-short switches per year are 114, 26 and 6.5, respectively.

- Delaying signal execution by one trading day materially reduces, but does not eliminate, strategy performance.

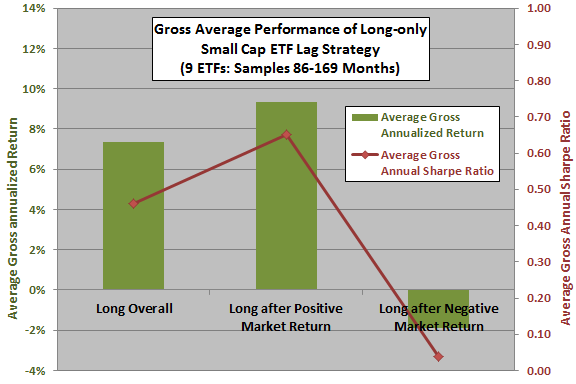

- Over the past 10-15 years, a simple trading strategy that is each month long small capitalization ETFs (in cash) when the prior-month broad market return is positive (negative) outperforms buying and holding the ETFs (see the last chart below).

- Average gross annualized return (gross annual Sharpe ratio) for this strategy across nine small capitalization ETFs is 9% (0.65), compared to 7% (0.46) for buying and holding the ETFs.

- The average gross four-factor alpha across ETFs is 6%, compared to -1% for buy-and-hold.

- Gross performance of strategies that exploit the performance lag of small capitalization stocks varies inversely with market liquidity as measured by impact of trading on price (but so do trading frictions).

- The driver of the trend lag for small capitalization stocks is the tendency of institutions to spread position changes in small and illiquid stocks over several days as they split orders to minimize price impact.

The following charts, taken from the paper, track gross cumulative returns to a “spillover” strategy that is long (short) the size effect [smallest decile return minus biggest decile return] following days, weeks or months with positive (negative) market returns. For the upper chart, there is no delay between calculation of the market return and signal execution. For the lower chart, there is a one-day delay. Results indicate that these approaches to capturing the size effect work, but that signal execution delay materially reduces performance.

The next chart, constructed from data in the paper, depicts average gross annualized returns and average gross annual Sharpe ratios for three strategies applied to a selection of small capitalization ETFs as available through 2014:

- Long Overall: buy and hold the ETFs from inceptions.

- Long after Positive Market Return: hold the ETFs following months when the value-weighted monthly market return is positive and otherwise hold cash with zero interest.

- Long after Negative Market Return: hold the ETFs following months when the value-weighted market monthly return is negative and otherwise hold cash with zero interest.

Results indicate that small capitalization ETFs tend to lag broad market returns at a monthly horizon, on average performing exceptionally well (poorly) after positive (negative) market returns. Trading frictions, while not large, would reduce the performance of the two timing strategies.

In summary, evidence indicates that investors may be able to exploit the tendency of small and illiquid stocks to lag broad market price trends.

Cautions regarding findings include:

- As noted in the paper, reported performance metrics are gross, not net. Accounting for trading frictions and shorting costs would reduce performance as applicable. Shorting of all specified stocks may not be feasible (especially when shorting the size effect/small stocks).

- Outperformance of the long-only ETF strategy relative to buy-and-hold based on gross annualized return is not dramatic (2% per year), and the sample period is not long in terms of market cycles.