Are higher even moments of asset return distributions useful predictors of future returns? In the September 2015 version of her paper entitled “A Low-Risk Strategy based on Higher Moments in Currency Markets”, Claudia Zunft explores an adaptive currency trading strategy that exploits the predictive power of higher even moments of forward currency exchange rate returns. The strategy is each month long (short) the equally weighted fifth, or quintile, of currencies with the lowest (highest) higher even return moments relative to recent past levels. For each currency, she first computes 13 even daily return moments over the last month (versus the U.S. dollar) ranging from 4 to 100 and then subtracts from these moments their respective average monthly values over lookback intervals of 12, 24, 36, 48 and 60 months and inception-to-date. From the resulting 78 combinations of moments and lookback intervals, she each month selects the combination with the highest average excess portfolio return over the last three months. For comparison, she also tests long-short quintile carry trade (high interest rate currencies minus low interest rate currencies) and momentum (high prior-month return currencies minus low prior month currencies) portfolios. Using bid, ask and mid-quote spot and forward contract (maturities up to a year) exchange rates versus the U.S. dollar for 20 of the most liquid developed and emerging market currencies as reliably available during December 1989 through October 2014, she finds that:

- Higher even moment portfolios with fixed moment/lookback interval settings deliver highly significant (significant) positive average excess returns for 71 (7) of 78 combinations. The adaptive higher even moment strategy has a higher gross mean excess return and Sharpe ratio than any portfolio with fixed settings.

- The adaptive higher even moment strategy outperforms carry and momentum strategies, generating (for one-month forward contracts):

- Gross average annual return 11.1%, compared to 10.5% for carry and 7.2% for momentum.

- Gross annual Sharpe ratio 1.38, compared to 1.08 for carry and 0.84 for momentum.

- Smaller drawdowns than carry and momentum.

- The adaptive higher even moment strategy is distinct from the carry and momentum strategies.

- Double sorting indicates that the strategy works for portfolios of currencies with high and low interest rates and with high and low momentum.

- The correlation of monthly strategy returns is only 0.28 (0.19) with the carry (momentum) strategy.

- Both spot exchange rate movements and interest rate differentials drive strategy performance, while only interest rates drive carry and only spot movements drive momentum.

- When added to a multi-factor (carry, momentum, volatility) currency portfolio, the strategy boosts gross annual Sharpe ratio from 1.41 to 1.71.

- Widely used risk factors do not explain adaptive higher even moment strategy performance.

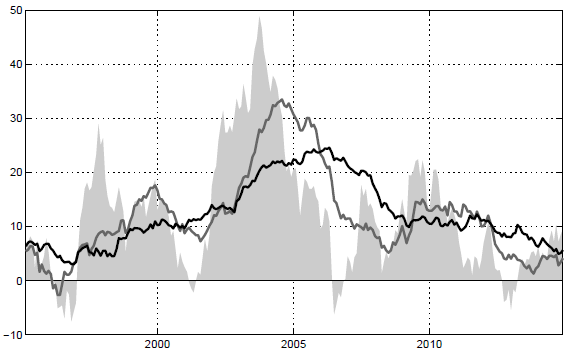

- The adaptive higher even moment strategy is reliable, with a negative three-year rolling average return for only 2.1% of months (see the chart below), compared to 8.4% for carry and 19.3% for momentum.

- Performance of the optimal (second nearest forward contract) adaptive higher even moment strategy remains significantly positive after accounting for trading frictions (bid-ask spread), reducing average annual excess return from 11.2% to 8.7% and annual Sharpe ratio from 1.32 to 1.05. While strategy turnover is substantially lower than that for momentum, it is considerably higher than that of carry.

The following chart, taken from the paper, tracks at a monthly frequency the performance of the adaptive higher even moment currency strategy applied to nearest forward contracts over the sample period in three ways:

- Gross excess return over the last year (gray shading).

- Average gross annual excess return over the last three years (gray line).

- Average gross annual excess return over the last five years (black line).

The vertical axis is in percent. Results show that the strategy rarely has gross losses.

In summary, evidence indicates that the adaptive higher even moment currency trading strategy is attractive relative to comparable carry and momentum strategies, but complex in execution.

Cautions regarding findings include:

- The adaptive higher even moment strategy is complex and data/compute-intensive. Most investors would have to delegate portfolio maintenance, thereby incurring fees.

- As indicated in the chart above, strategy profitability concentrates in the subperiod 2002 through 2007. Such conditions may not recur.

- A comparison of net performance of the adaptive higher even moment strategy and the carry strategy would be interesting, given the much lower turnover of the latter.

- There is snooping bias associated with identifying the optimal forward contract (second nearest) for the strategy, such that results tend to overstate expectations.

- Net performance estimates do not account for costs of data/software/processing or broker fees.