What does a large online repository of research on financial markets say about community interactions? In the August 2015 version of his article entitled “Recent Trends in Empirical Finance”, Marcos Lopez de Prado measures trends in level of research activity, topical emphasis, level of interest as measured by downloads and level of collaboration. Based on data for 128,897 research papers by 72,070 authors posted on SSRN’s Financial Economics Network (as of June 4, 2015), he finds that:

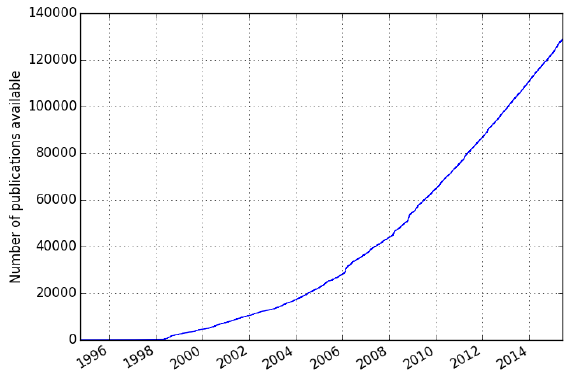

- The number of papers available triples over the last eight years (see the chart below).

- The most popular topic by far is asset pricing, followed by market efficiency, banking and risk management.

- Interest in posted papers is highly concentrated.

- The most popular paper [“A Quantitative Approach to Tactical Asset Allocation”] has 148,912 downloads.

- Only 144 papers (0.11%) have more than 10,000 downloads.

- The median number of downloads across the top 10% (bottom 90%) papers is 1,053 (56).

- The level of co-authorship and collaboration is very low compared to other academic fields:

- The average number of co-authors is two, and 36% of papers have solo authors.

- About 14% of authors are lone wolves (zero collaborators).

The following chart, taken from the article, plots the number of papers available via the SSRN Financial Economics Network over time. About 100,000 papers are added since 2006. The combination of this strong growth in number of papers and strong concentration of topics/downloads suggests intensively growing aggregate snooping bias in asset pricing research.

In summary, the investment research community is relatively asocial and should expand collaboration to avoid becoming “a pathological science, a collection of ‘cold fusion’ claims.”

Cautions regarding findings include:

- Some papers added to SSRN are archival and not new research, enhancing research access but exaggerating rate of growth. SSRN also makes exposure available to international research focused on local markets.

- Collaboration is problematic if the (unstated) goal of posting research is to engage in proprietary asset management.

See the closely related “Fixing Empirical Finance”.