Are currency carry and momentum strategies complementary? If so, why? In their July 2015 paper entitled “Carry and Trend Following Returns in the Foreign Exchange Market”, Andrew Clare, James Seaton, Peter Smith and Steve Thomas examine how market liquidity affects returns to currency carry and trend following strategies and test the benefits of combining these two strategies. They measure carry strategy returns via a portfolio that is each month long (short) the equally weighted currencies with the largest (smallest) returns as implied by differences between one-month forward and spot rates. They measure trend following strategy returns via a portfolio that is each month long (short) the equally weighted currencies with last-month returns above (below) respective moving average returns over the past four to 12 months. Using end-of-month spot and one-month forward exchange rates for 39 currencies versus the U.S. dollar as available during January 1981 through December 2012, they find that:

- Over the entire sample period, the currency carry strategy generates good average returns and an attractive gross Sharpe ratio, but with relatively large maximum drawdown and significant negative skewness (frequent poor returns).

- The trend following strategy has a somewhat less attractive gross Sharpe ratio, but a relatively low maximum drawdown and does not exhibit negative skewness.

- The carry strategy exhibits elevated risk when market liquidity is low, while the trend following strategy hedges illiquidity risk.

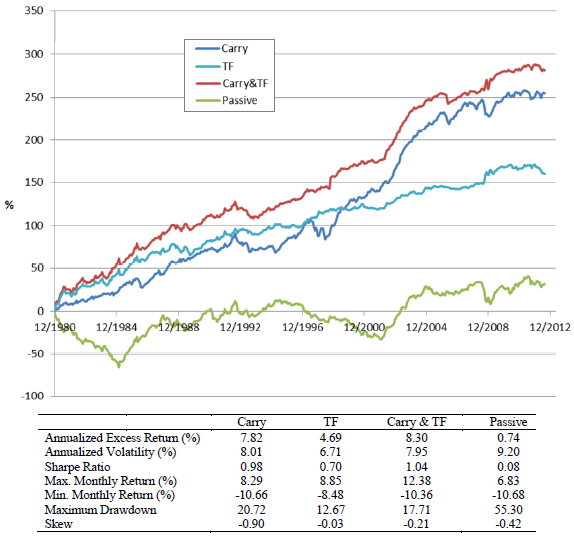

- Thus, the carry strategy combined with a trend following overlay generates a higher gross Sharpe ratio than either of the component strategies, and suppresses carry maximum drawdown and negative skewness (see the chart and table below).

The following chart and table, taken from the paper, summarize gross cumulative performances of four currency portfolios:

- Carry – each month long (short) the equally weighted five currencies with the highest (lowest) carry returns.

- Trend Following (TF) – each month long (short) the equally weighted currencies with last-month returns above (below) respective 6-month moving average returns.

- Carry & TF – the Carry portfolio with the TF filter applied to individual currencies, retaining only those long (short) carry positions with a positive (negative) trend.

- Passive – long all currencies, equally weighted.

Results indicate that combining carry and trend following strategies is attractive, with the highest Sharpe ratio and a maximum drawdown lower than that of carry alone (which has the next-highest Sharpe ratio). In particular, the combined strategy benefits from the strong performance of carry during 2001-2005 and the strong performance of trend following during the 2008 financial crisis.

In summary, evidence indicates that a currency trend following strategy hedges currency carry strategy illiquidity risk, such that combining the strategies boosts gross Sharpe ratio.

Cautions regarding findings include:

- As noted, reported returns are gross, not net. Incorporating costs of monthly portfolio reformation would lower currency strategy performance.

- An investor delegating currency spot/forward data collection/analysis and trade execution to a manager would bear fees.