Do dual-sorts of country stock market predictive factors add value to single-sorts? In the July 2015 version of his paper entitled “Combining Equity Country Selection Strategies” Adam Zaremba first re-examines earnings-price ratio (E/P), momentum (return from 12 months ago to one month ago), skewness (based on the last 24 monthly returns) and turnover ratio (average monthly turnover for the past 12 months) as country stock market predictive factors. He then investigates whether combined sorts on two factors outperform single-factor sorts. For each individual factor, he sorts country stock markets into fifths (quintiles) and measures the factor premium as the difference in returns between the highest and lowest quintiles. He focuses on market capitalization weighting within quintiles but considers equal and liquidity (average turnover) weighting schemes as robustness checks. For dual sorts, he computes combined ranking as the average of component factor rankings and then forms quintile portfolios. Using monthly total returns adjusted for local dividend tax rates in U.S. dollars for 78 existing and discontinued country stock indexes (primarily MSCI) during 1999 through March 2015, he finds that:

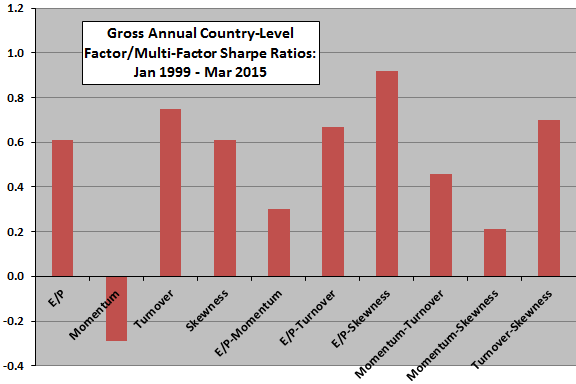

- Long-short portfolios based on E/P, turnover and skewness appear useful for screening country stock markets (see the chart below). Momentum does not work at the country level.

- Long-short dual-factor portfolios based on E/P-turnover, E/P-skewness and turnover-skewness also appear attractive, but they do not strongly outperform the three single-factor portfolios.

- Given the low pairwise return correlations among long-short single-factor E/P, turnover and skewness portfolios (-0.16 to 0.10), diversification with these three single-factor portfolios likely works better than dual-factor sorts.

The following chart, constructed from data in the paper, summarizes gross annual Sharpe ratios for four single-factor and six dual-factor long-short country stock market portfolios over the sample period. Portfolios are long the capitalization-weighted quintile of country markets with the highest expected returns and short the quintile with the lowest (somewhat different from the approach for single factors in the paper). Specifically, premiums come from portfolios based on:

E/P – highest minus lowest earnings yield quintiles.

Momentum – highest minus lowest past return quintiles.

Turnover – lowest minus highest share turnover (market liquidity) quintiles.

Skewness – lowest minus highest average monthly skewness quintiles.

Any pair of these four factors, combined as specified above.

Results suggest that E/P, turnover and skewness offer attractive gross premiums at the country level, but momentum is not attractive. Among dual-factor portfolios, only E/P-skewness offers a promising boost over single-factor constituents.

In summary, evidence from the past 16 years suggests that dual-factor country-level stock market portfolios generally offer little improvement over the best single-factor portfolios.

Cautions regarding findings include:

- The sample period is short relative to many factor premium measurement intervals (only 16 independent one-year intervals).

- Testing many single-factor and dual-factor portfolios on the same data introduces snooping bias, such that the best-performing strategies likely overstate expectations. Moreover, the selection of single factors relies on outcomes of similar prior research (see “Country Stock Market Factor Strategies”), so there is secondary snooping bias in the research design.

- The test assets are indexes rather than tradable funds, ignoring the costs of maintaining liquid funds and thereby overstating series returns. These costs probably vary substantially across countries.

- The study does not account for trading frictions associated with monthly reformation of quintile portfolios. Nor does it account for any shorting costs. These frictions and costs would lower returns and may vary considerably across countries and factors.