Are positive carry and positive trend conditions consistently favorable across asset classes? In their March 2015 paper entitled “Carry and Trend in Lots of Places”, Vineer Bhansali, Josh Davis, Matt Dorsten and Graham Rennison employ futures prices to investigate whether the adages “don’t pay too much to hold an investment” and “don’t fight the trend” actually work across four major asset classes: equities, bonds, commodities and currencies. For testing, they select five liquid markets with relatively long futures histories within each asset class. They define carry as annualized excess return assuming that spot prices do not change. They define trend as positive (negative) if the futures price today is above (below) its one-year trailing moving average. They specify four states for each market:

- Positive carry and positive trend (Carry + / Trend +).

- Positive carry and negative trend (Carry + / Trend -).

- Negative carry and positive trend (Carry – / Trend +).

- Negative carry and negative trend (Carry – / Trend -).

They then calculate average subsequent daily excess returns for each market by state and annualize results. Using daily futures data as available and some simulated futures data (from spot prices) for 20 major markets across four asset classes during 1960 through 2014, they find that:

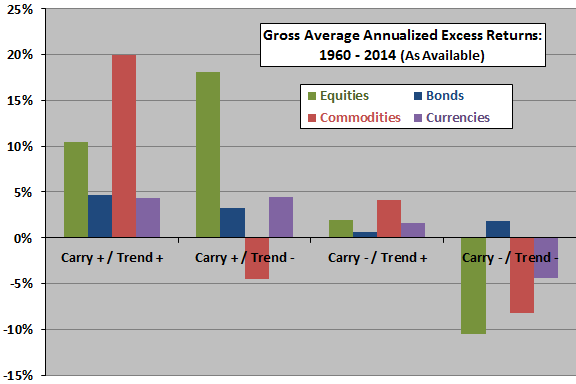

- Positive carry and trend conditions imply relatively strong future returns (see the chart below). In particular, Carry + / Trend + consistently beats Carry – / Trend -.

- The most favorable Carry + / Trend + state occurs about:

- 30% of the time for equities.

- 52% of the time for bonds.

- 26% of the time for commodities.

- 28% of the time for currencies.

- Findings are robust across subperiods, including that of rising interest rates during 1960 through 1982.

- While carry predicts returns almost unconditionally, trend-following works much better when carry is in agreement.

The following chart, constructed from data in the paper, summarizes gross average annualized future excess returns for the four asset classes by carry-trend state. Findings indicate that:

- Carry + / Trend + is always better than Carry – / Trend -.

- Carry + / Trend + is not always better than Carry + / Trend -.

- Carry + / Trend – is always better than Carry – / Trend -.

- Carry – / Trend + is usually better than Carry – / Trend -.

In summary, evidence indicates that carry and trend tailwinds are generally favorable for future returns across stocks, bonds, commodities and currencies.

Cautions regarding findings include:

- Reported returns are gross, not net. Accounting for the costs of changing positions with the carry-trend state would lower these returns.

- The paper does not test any strategy for timing or switching among assets based on carry-trend states.

- Some returns, in the absence of direct measurement prices, are simulated. Simulated data do not account for feedback to the market from trading or for market maker costs.

- As noted, Carry + / Trend + does not always outperform partly positive states, and partly positive states do not always outperform Carry – / Trend -.

- As noted in the paper, there may be more effective ways to measure carry and trend.

- Testing signals on many markets involves some snooping bias, such that the strongest indications tend to overstate expectations.